Nestled down in the bowels of the Consumer Price Index (CPI) data that is released each month is the retail price of beef, pork, and chicken. Each have reached record highs at some point in the last couple of years adding to overall food price inflation. The latest CPI data for meats indicated some stabilization or decline in meat prices.

First off, it’s worth remembering what this data represents. It is the price of various cuts of beef, pork, and chicken reported from grocery stores during the second week of the month. The data does not include special features, sales, in store coupons, or customer loyalty card discounts. As a grocery store price, it does not include meat prices at restaurants.

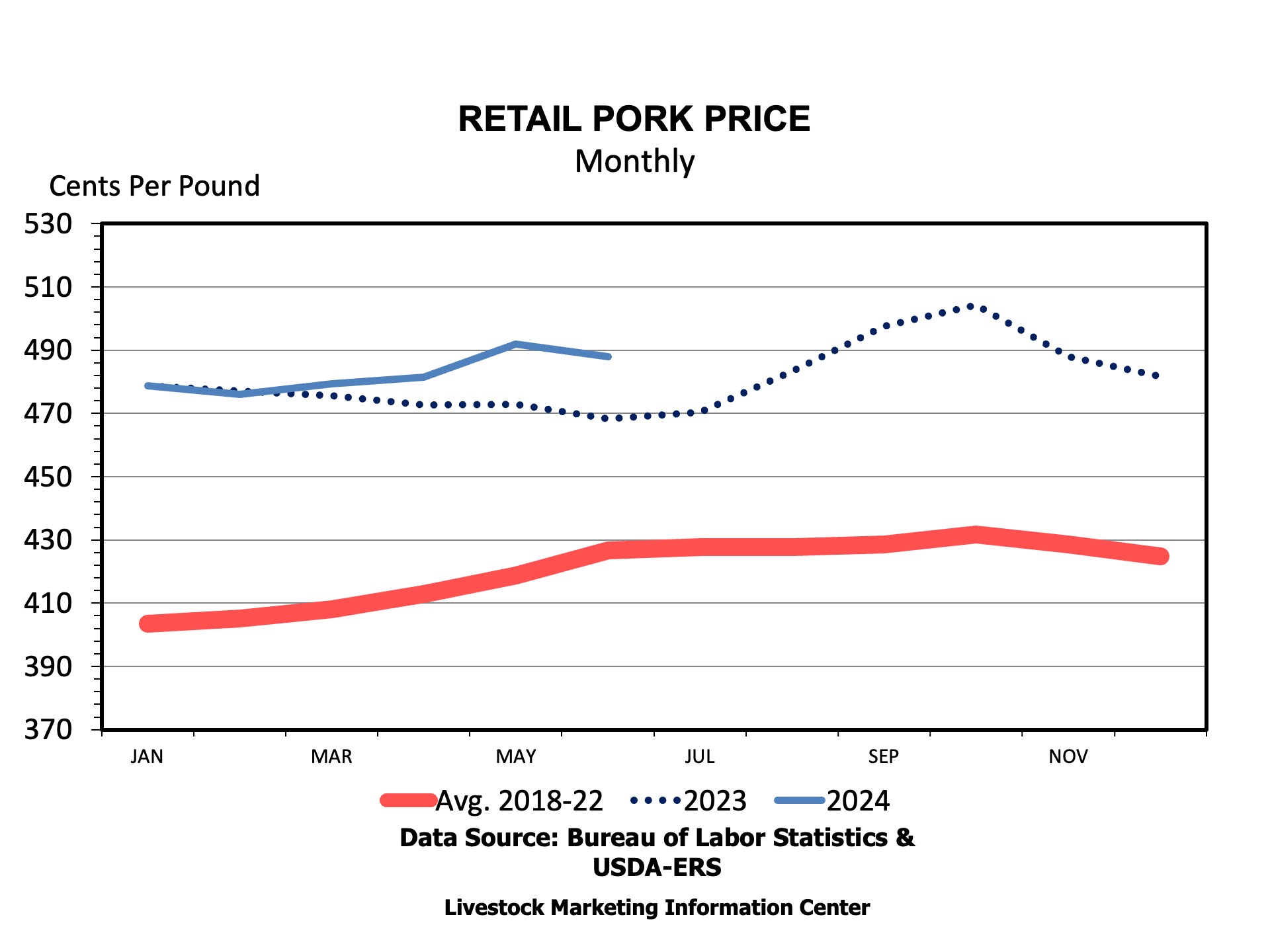

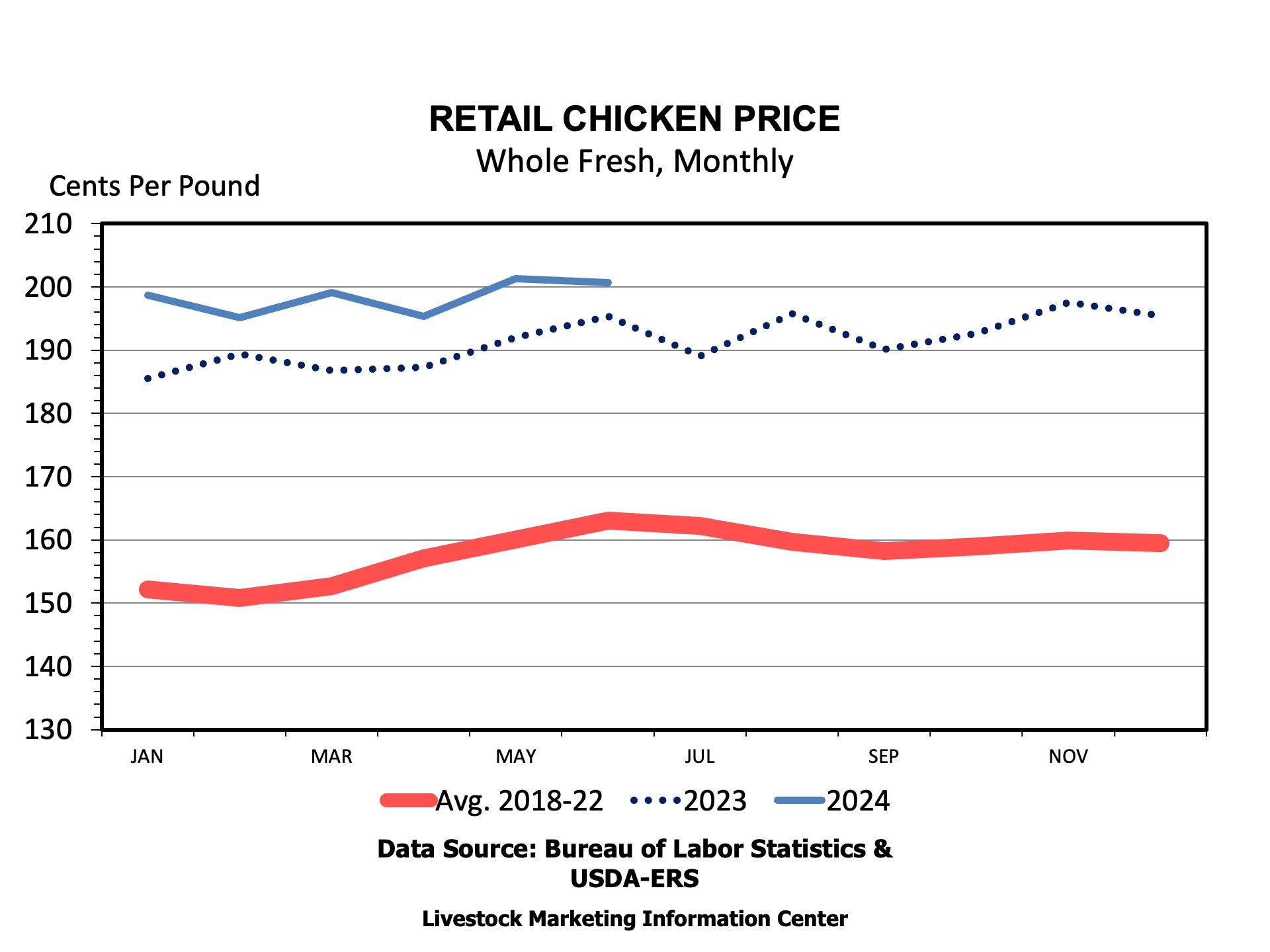

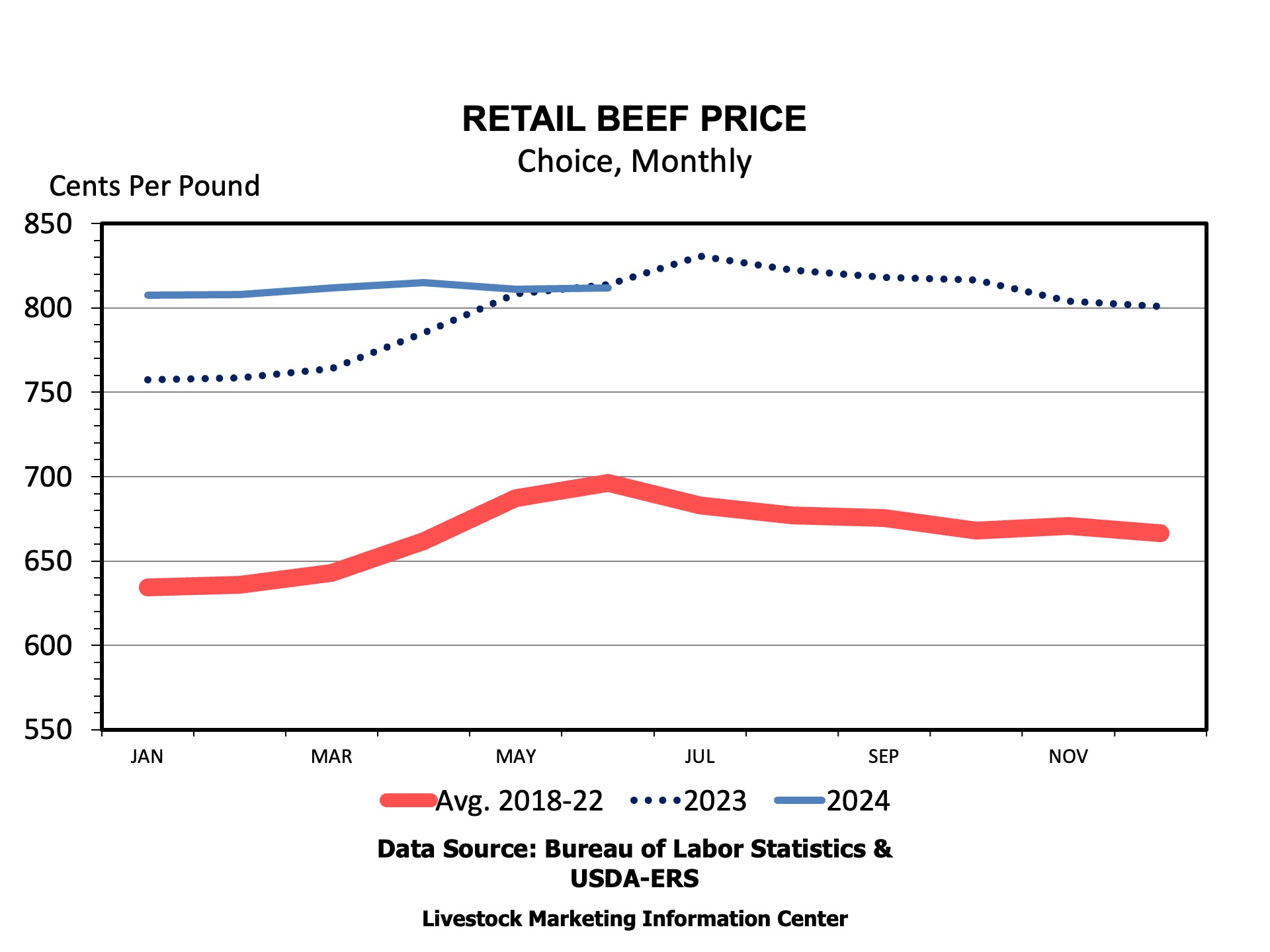

Meat prices (and production for that matter) exhibit a considerable amount of seasonality. Both supply and demand factors contribute to price seasonality. For example, on the supply side, pork production tends to peak in the Fall after hitting its seasonal lows in Summer. Tighter supplies in the Summer would suggest that prices should peak in Summer. But, on the demand side, individual cuts may peak at different times of the year, for example, hams at the holidays or grilling season favorites. Economists often compare the most current price to those of last year at the same time, simply to account for normal seasonality of prices. But, for many consumers thinking about inflation a more useful comparison might be to last month or the last couple of months to account for the trend in prices.

The latest data represents June prices across the U.S. The Choice beef price in June was $8.119 per pound, less than 1 cent per pound higher than May. So far this year, Choice beef prices peaked in April at $8.151 per pound. Compared to a year ago, beef prices were about 2 cents lower per pound. Pork prices totaled $4.88 per pound in June compared to $4.919 per pound in May and $4.684 per pound in June of last year. Chicken prices are reported in two ways: as a whole, fresh bird retail price or as a composite price made up of various cuts. The composite retail price was $2.403 per pound in June compared to $2.44 in May and $2.504 in June 2023.

On the whole, the latest retail meat price data indicates some easing of meat price inflation in June. Some recent falling cutout values for beef and pork related to more production of both relative to last year could be part of the reason for lower prices. Some consumer push back against high prices could have pressured prices lower as well. Retail prices the rest of the year will be affected by reduced beef supplies and more pork and poultry.

Anderson, David. “Retail Meat Prices Ease a Little.” Southern Ag Today 4(29.2). July 16, 2024. Permalink