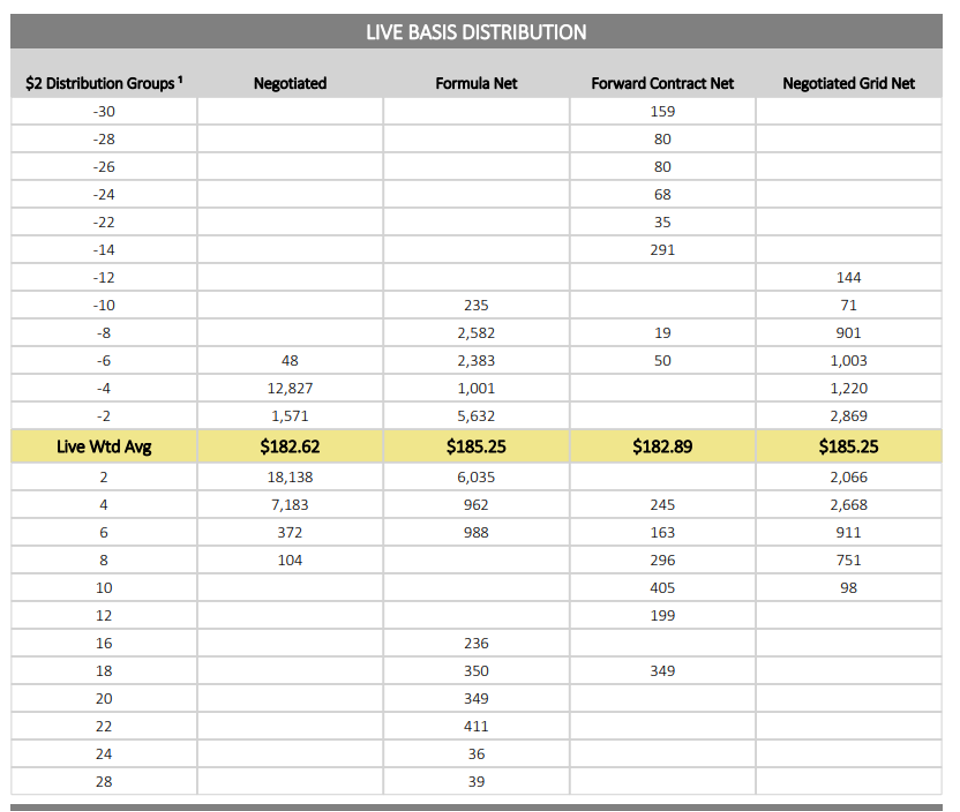

In August 2021, the USDA announced a new market news report that would contain the distribution of weekly US fed cattle prices using price “bins” (LM_CT215). What makes this report unique is the way that price data are reported. Prices are reported in $2 increments, or bins, for negotiated cash, net formula, net forward contract, and negotiated grid nets. Figure 1 shows an example of how these weekly data are reported. The weekly weighted average live fed cattle price is highlighted in Figure 1. The number of fed cattle selling at each $2 per cwt premium or discount to the average is reported in the grid.

Figure 1. Snapshot of Data Reported in USDA National Weekly Direct Beef Type Price Distribution (LM_CT215)

The new distributional data allow market participants to understand fed cattle prices in more detail and go beyond minimum, maximum, and average prices for each marketing type. With this new distributional dataset for formula and negotiated fed cattle prices, we[1] analyzed how weekly prices between these two markets interact with each other. One objective of our study centered around the impacts of negotiated prices on cattle markets. Specifically, as concerns have risen in relation to a possible thin cash market, we wanted to understand whether or not negotiated prices impact formula prices, or if it’s the other way around, as some market participants have suggested. Figure 2 displays a visual representation of the results from our study and shows how prices interact with each other (from August 10, 2021, to May 14, 2024). Current negotiated (orange) and formula (blue) prices for a given week are in the middle. We found that, depending on the market, current prices are impacted by the preceding three weeks of prices (the two columns on the right and left).

Figure 2. Negotiated Cash and Formula Fed Cattle Price Relationship Flow Chart. Data is weekly for the time range, August 10, 2021, to May 14, 2024 (n = 145).

Our study found that the current negotiated cash price for a given week (top middle orange box) is positively impacted by the week prior negotiated cash price (green dotted line), and negatively impacted by the negotiated price 3-weeks prior (solid red line). Current formula prices were found to be positively impacted (green dotted line) by the formula price from the prior week and the prior two weeks of negotiated fed cattle prices. However, formula prices were negatively impacted (solid red line) by formula price from two weeks prior.

Despite concerns that the negotiated cash market is too thin and does not provide marketing information to the formula market, we find that the negotiated price does influence the formula fed cattle price. We find evidence supporting the conclusion that negotiated cash price information is being transmitted to formula price variability, which is expected because formula prices are designed to be based on the negotiated trade. Our results also indicate that formula prices do not impact on the negotiated price.

[1] Boyer, C.N., E. Park, A. F. Ramsey, and C. Martinez. 2024. “Formula and Cash Negotiated Fed Cattle Price Relationships”. Journal of Agricultural and Resource Economics, forthcoming.

Martinez, Charley, Christopher Boyer, Eunchun Park, and A. Ford Ramsey. “The Relationship Between Formula and Negotiated Cash Fed Cattle Prices.” Southern Ag Today 4(34.2). August 20, 2024. Permalink