In previous Southern Ag Today articles, the rising agricultural trade deficit was reported. The latest USDA Outlook for U.S. Agricultural Trade report (August), forecast a $30.5 billion trade deficit for FY 2024 with exports at $173.5 billion and imports at $204 billion (Kenner et al., 2024). Moreover, for FY 2025, USDA forecast an even larger trade deficit at $42.5 billion with exports at $169.5 billion and imports at $212 billion. As mentioned in previous articles, when we measure trade in volume the U.S. enjoys a 3.2 export to import ratio over the last 10 years, meaning that the U.S. exports more than three times the volume that we import. The reason is that we tend to export products that are sold in bulk, such as soybeans, corn and wheat and we import more high value agricultural and food products such as beer, wine, spirits and fresh fruits and vegetables.

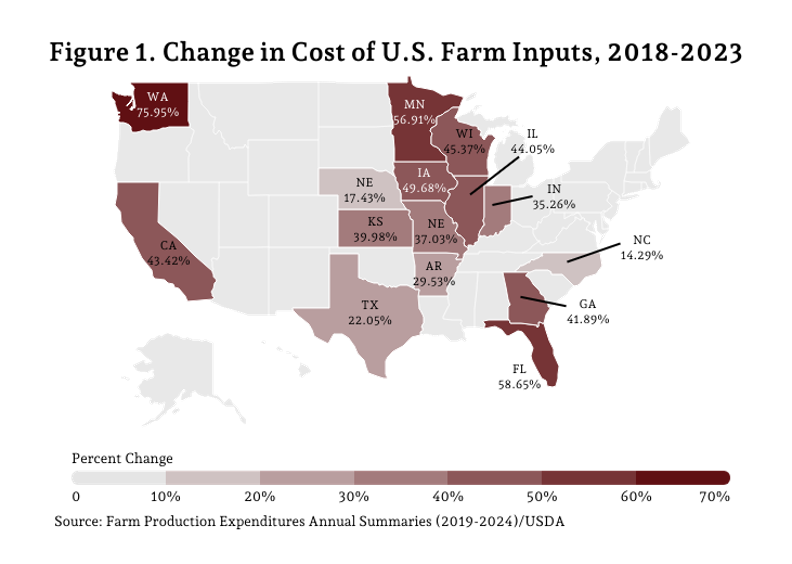

One of the main contributors to the loss of competitiveness of U.S. agricultural products in the international arena is the increase of cost of production. Figure 1 shows how the cost of farm inputs has risen in recent years. In 2018, U.S. farmers spent a total of $354 billion on inputs, however, by 2023 farmers spent $481.9 billion, an increase of 36 percent. Southern states (categorized by the USDA to include Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, and South Carolina) together saw farm inputs rise 37.65% over this time. The inputs purchased by these seven states accounted for 10.4 percent of the total for the United States. Texas, grouped into the Plains region, accounted for 6.35 percent of the U.S. total. Of the southern states, Florida experienced the highest rise in cost of inputs during this time, increasing 58.65 percent from 2018 to 2023.

Ribera, Luis, and Landyn Young. “Increase in Cost of Production Contributing to Trade Deficit.” Southern Ag Today 4(42.4). October 17, 2024. Permalink