On September 28, India lifted its export ban on non-basmati white rice and replaced it with a minimum export price (MEP) policy of $490/metric ton. On October 20, India announced the removal of the MEP policy on non-basmati white rice and the removal of export duties on other rice products (e.g., parboiled, husked, and paddy rice), effectively freeing rice exports. While this measure was expected anytime and the global rice market was already factoring in the change to some extent, the announcement is creating shockwaves throughout the global rice market.

India implemented the export ban on July 20th, 2023 (see https://southernagtoday.org/2023/07/27/shaking-the-global-rice-market-india-bans-exports-of-white-non-basmati-rice/) amid fears of a short rice crop due to the projected dry Monsoon that never materialized. India harvested a record rice crop (137.8 million metric tons) in 2023/24, but the export ban remained in place. Fast-forwarding to the current year 2024/25, the weather has been beneficial, and India is projected to harvest a new record crop (estimated at 142 million metric tons in October according to USDA) and carry record-high stocks. In summary, India’s production performance has been outstanding, which undermined the rationale for keeping the export ban for so long.

Since late September when India started easing exports, Asian rice prices have been under downward pressure despite the strong import demand, primarily from Indonesia and the Philippines. For instance, the export price of Thai 5% rice dropped below $500/metric ton in mid-October for the first time since July 2023 (Creed Rice Market Report, 2024; USDA, 2024a), while that of Pakistani 5% rice dropped more drastically as Pakistan competes more directly with India in many African markets. The latest Creed Rice Market Report (November 6th) suggests India’s export price for non-basmati white 5% rice is around $465/metric ton.

In contrast, rice prices in the Western hemisphere are still at a much higher level than those in Asia, and the downward pressure has not been felt so hard, at least not yet. For example, the average export price for Southern 4% long-grain rice average $779/metric ton in 2023/24 and has hovered around $800/metric ton since August. Export prices out of Mercosur have also fluctuated between $770-790/metric ton in the last few weeks. While Western hemisphere long-grain rice has historically enjoyed a price premium relative to Asian long-grain rice, we should expect an increasing downward price pressure in the coming weeks and months as India’s rice harvest and the Mercosur’s rice crop advances.

The million-dollar question for the U.S. rice industry is how will prices adjust this coming year, and the answer is: it depends. First, it will depend on the (most likely) downward adjustment in Asian export prices, which in turn depends (among other things) on how much rice India exports. A quick analysis using the Arkansas Global Rice Model (AGRM) and assuming India exports according to USDA projections in October (21 million metric tons) bring prices to $450/metric ton. However, if India decides to liquidate some stocks as well further increasing exports, prices may drop even further. Second, it will depend on the level of market integration with Asia. While historically Asian rice has not been prominent in the Western hemisphere, its presence is growing. The more market integration, the more pressure we should expect to receive, and an increasing price gap between Asian and Western Hemisphere rice could fuel market integration. Third, it will depend on the rice crop in Mercosur (South American countries that compete with U.S. long grain rice). USDA projects a slight increase in planted area relative to last year, which could result in more competition in core U.S. export markets.

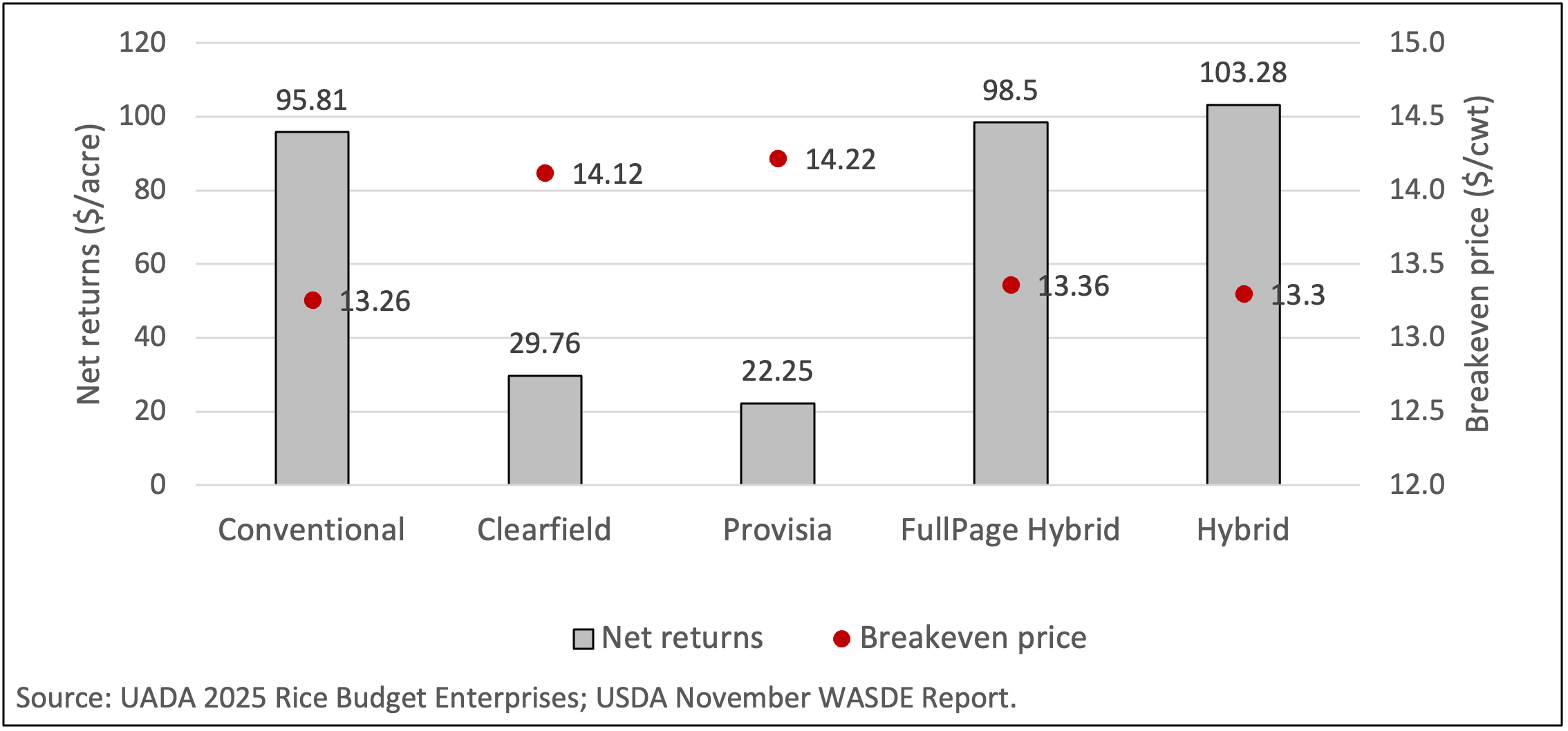

Finally, it is important to discuss how much room there is for price adjustments and profitability. The November WASDE report (USDA, 2024b) maintains long-grain farm prices unchanged at $14.50/hundredweight ($319/metric ton). Using that farm-price as a reference and the University of Arkansas Division of Agriculture 2025 Rice Enterprise Budgets (Figure 1), we estimate the average net returns to range from $22.25 to $103.28/acre for the different rice production systems, significantly lower than last year’s net returns, which ranged from $97.50 to $153.70/acre. We estimate the 2025 breakeven prices to range from $13.26 to $14.22/hundredweight (cwt) across production systems. The downward pressure on prices due to India’s liberalization of rice exports could push farm prices further down in the coming months, which could further decrease the economic returns and affect the 2025 rice planting intentions.

Figure 1. Arkansas: Projected 2025 Net returns and Breakeven Price.

References

Creed Rice Market Report. 2024. Several issues. Available at https://www.riceonline.com/

University of Arkansas Division of Agriculture. 2024. 2025 Arkansas Crop Enterprise Budgets. Available at https://www.uaex.uada.edu/farm-ranch/economics-marketing/farm-planning/budgets/crop-budgets.aspx

USDA. 2024a. Rice Outlook. October 2024. Available at https://www.ers.usda.gov/publications/pub-details/?pubid=110218

USDA. 2024b. WASDE Report. November 2024. Available at https://www.usda.gov/oce/commodity/wasde

Durand-Morat, Alvaro. “What to Expect from India’s Removal of the Export Ban on White Non-Basmati Rice.” Southern Ag Today 4(46.4). November 14, 2024. Permalink