As the 2024 peanut harvest wraps up, peanut prices remain relatively stable compared to prices of other crops. Corn, soybeans, cotton, wheat, and rice have had significant price decreases since the 2022/23 marketing year, while peanut prices have experienced only a slight decrease over that period. Peanut prices are projected to average $530 per ton for the 2024/25 marketing year, just below the $536 and $538 per ton observed for the 2022/23 and 2023/24 marketing years, respectively. This price stability comes as peanut ending stocks have remained low and stable, which is expected to continue into the 2024/25 marketing year.

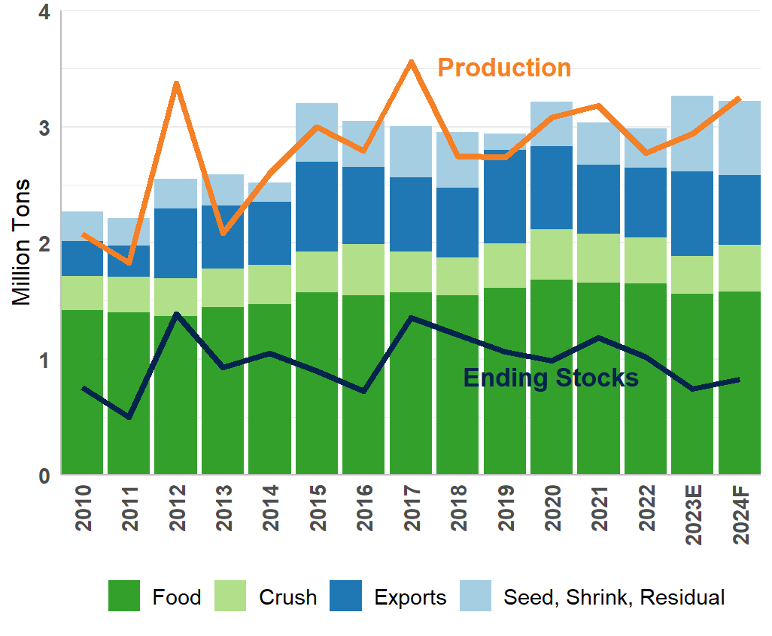

Figure 1: Peanut Production, Disappearance, and Ending Stocks by Year

Peanut production is expected to increase in 2024, driven by the 10% increase in planted acreage. If current USDA projections are realized, peanut production would total 3.3 million tons, an 11% increase from 2023, as shown in the orange line of figure 1. Georgia leads the way with an expected 1.65 million tons of peanut production, followed by Florida (297,850 tons), Alabama (297,600 tons), and Texas (262,500 tons). The increased nationwide production comes despite a projected U.S. peanut yield of just 3,723 lb. per acre, which is 1.4 percent below the 2023 yield and the lowest yield since 2016.

On the demand side, peanut disappearance is projected to keep pace with the increased production, as shown by the bars in Figure 1. Peanuts processed for domestic food products, which account for about half of U.S. peanut disappearance, are expected to increase by 1% to 1.58 million tons. Peanut crush is expected to increase by 22%. In contrast, exports are forecast to decrease by 18% to 600,000 tons. As a result of the strong production, ending stocks are expected to increase to 823,000 tons, but this would still be the second lowest total since 2016. Overall, these tight supplies may suggest that peanut prices remain favorable next year. Despite the relatively favorable peanut price situation, peanut profitability remains a major concern due to the elevated production costs identified in the article titled “The Long Term Economic Struggles of Southern Peanut Farmers.”

Sources:

USDA Economic Research Service. Oil Crops Outlook: November 2024. Available at: https://www.ers.usda.gov/publications/pub-details/?pubid=110380

USDA. Peanut Stocks and Processing: November 25, 2024. Available at: https://usda.library.cornell.edu/concern/publications/02870v87z

Sawadgo, Wendiam. “Peanut Stocks Expected to Remain Low in 2025.” Southern Ag Today 4(49.3). December 4, 2024. Permalink