Many producers don’t like doing record keeping. Keeping up-to-date records can be time-consuming and sometimes boring, with having to sift through all your deposits and receipts and then input these into spreadsheets and creating income and cash flow statements. The reward is not always readily seen compared to other farming activities. If you have weeds in your field and you spray it with herbicide, the weeds die. If you feed your calves, they gain weight. Conversely, the benefits of record-keeping may not be seen for months, but it can be the difference between losing and making money.

Good records are the foundation of decision-making on the farm and should be used to inform your marketing, crop insurance, and loan choices. Any decision made on the farm has a financial impact that affects your revenue, costs, or both and, subsequently, your bottom line. Record keeping is important when things are tough as it allows you to evaluate areas of the farm that can be improved or where costs can be cut. The more detailed your records the more specific changes you can make. This will allow you to evaluate your farm as a whole, by specific crops, or even by specific fields, to determine where problems may arise. A detailed analysis could show that a field was unprofitable because it had some nutrient deficiencies or maybe the crop grown on that field needs to be re-evaluated. Or perhaps the terms of rental agreement is what is causing that field to not be profitable. After diagnosing the issue, you can then determine how changes to this field will impact the farm’s financial performance as a whole. In a tough year, this sort of evaluation is crucial to breaking-even or at least minimizing losses.

Record keeping is equally important when things are going well and to avoid overextending your farm financially. In a good year, the question that needs to be asked when making a large purchase, like equipment, is not “Can I afford this now?” but “Can I afford this over its lifetime?”. There are many instances when high market prices encourage large purchases that set a farm up for failure when prices inevitably fall. If a purchase causes your break-evens to increase so that it is only profitable when prices are above average or high, then it is a risky investment.

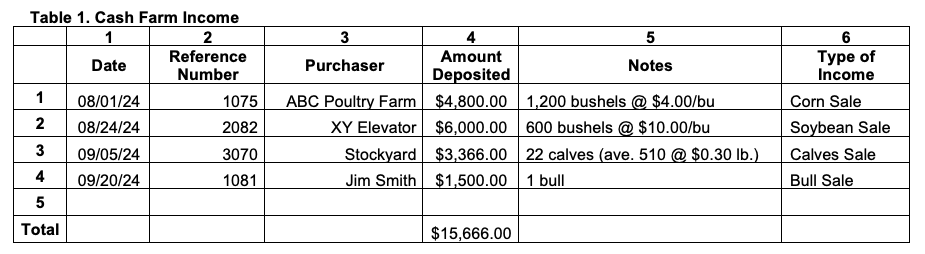

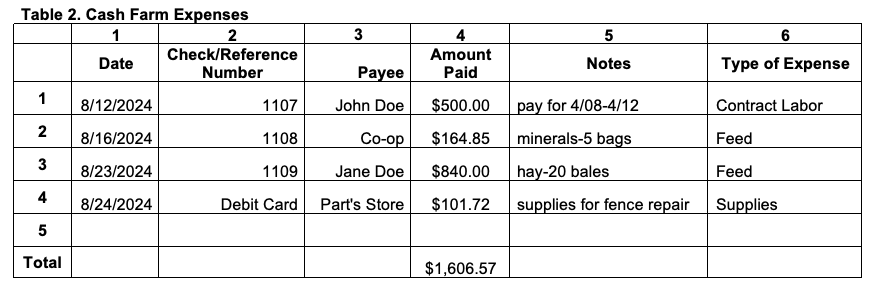

Accurate record-keeping starts with accounting for all income and expense transactions. For each income transaction, you should include: Date, Reference Number, Purchaser, Amount Deposited, and the Type of Income (Table 1). For expense transactions, the following should be included: Date, Check/Reference Number, Payee, Amount Paid, and the Type of Expense (Table 2). Having this information will ensure that each transaction is accurately recorded. The more detailed your record keeping, the more specific adjustments can be made.

There are programs that can help with record keeping, such as QuickBooks or Excel, or you can handwrite them. Any record-keeping is better than none. Many producers already have data on specific fields through yield maps, soil maps, etc. Using these along with your other records to make more specific evaluations and how these changes impact the farm’s financial statements and ratios is key to long-term financial stability.