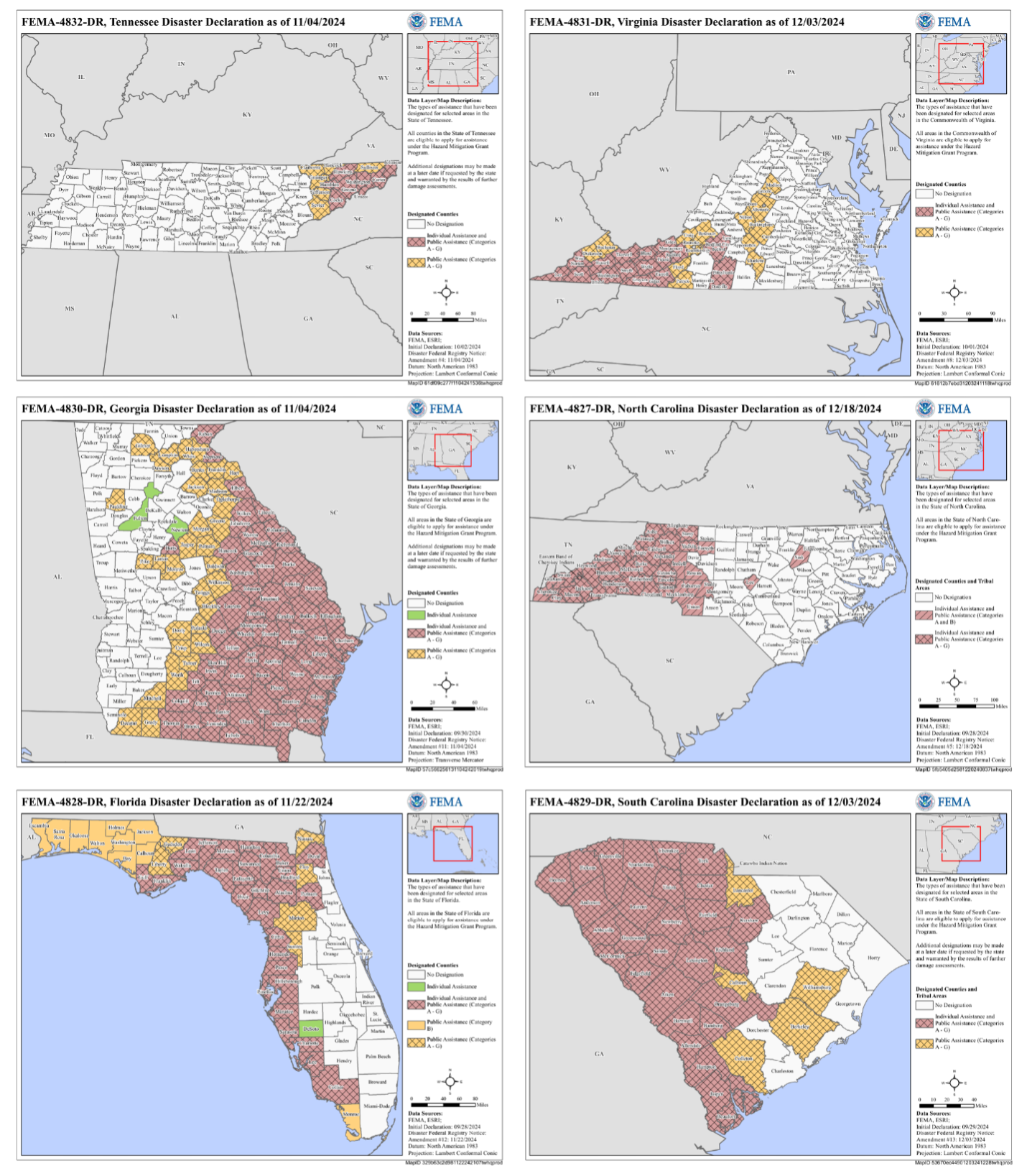

Hurricane Helene struck six southern states, from Florida to Virginia, in late September 2024. It made landfall in Florida’s Big Bend region as a Category 4 hurricane, weakened to a Category 2 across Georgia, and became a tropical storm as it moved through South Carolina, North Carolina, Tennessee, and Virginia. Over 250 counties have been declared federal disaster areas eligible for individual and/or public assistance (see Figure 1). Many timber owners in and near these areas have suffered significant timber losses. The hurricane caused around $1.86 billion in timber losses across 1.5 million acres, including some of the Southeast’s most productive timberland. While full recovery will take years, timber owners can take some immediate steps to mitigate losses, such as claiming timber casualty losses on federal income tax returns and conducting salvage timber sales.

There are a few key points for deducting timber casualty losses resulting from a federally declared disaster like Hurricane Helene and deferring taxes on salvage timber sales:

- Timber casualty loss deduction. You may be able to claim a deduction for timber casualty losses on your federal income tax return.

- Choice of tax year to claim the loss. If your damaged or destroyed timber was in a federally declared disaster area (see Figure 1), you can choose to claim the casualty loss on either your 2023 or 2024 tax return.

- Method for determining loss. Timber casualty losses should generally be determined using the timber depletion block approach, rather than simply adding up the value of the damaged or destroyed timber.

- Deduction limit. The deductible amount for timber casualty losses cannot exceed the adjusted basis of the affected timber depletion block. This amount is often lower than the retail value of the affected timber block.

- Salvage timber sales. Claiming a casualty loss deduction and conducting a salvage timber sale are separate events. You do not have to wait until you complete a savage sale to claim your timber casualty loss.

- Tax deferral on gains from salvage sales. You can defer taxes on profits from salvage timber sales if you use the proceeds to purchase qualifying replacement property.

For more information, please refer to this publication. Although the publication focuses on Georgia timber owners affected by Hurricane Helene, the general principles apply to timber losses caused by other casualty events, such as fires, floods, hurricanes, and storms. Please visit FEMA for the list of federally declared disasters related to Hurricane Helene in Florida (DR-4828-FL), North Carolina (DR-4827-NC), South Carolina (DR-4829-SC), Tennessee (DR-4832-TN), and Virginia (DR-4831-VA). Be sure to consult your accountant and/or tax specialists.

Figure 1. Designated areas due to Hurricane Helene

Timber Stand Damage