It is the heart of the winter in the southeastern broiler belt. January and February are typically the coldest, but March often comes in like a lion, bringing plenty of cold with it, too. Commercial poultry growers have embraced the risk management strategy of pre-buying or contract “booking” propane ahead to secure the lowest prices possible each year. But by the end of the season, it is not unheard of for growers to run out of pre-purchased or contracted allotments and be left subject to late-season cash market price fluctuations or potentially purchasing additional contract allotments at increased prices. This can leave growers wondering which option is best to end the season. There are several things to consider.

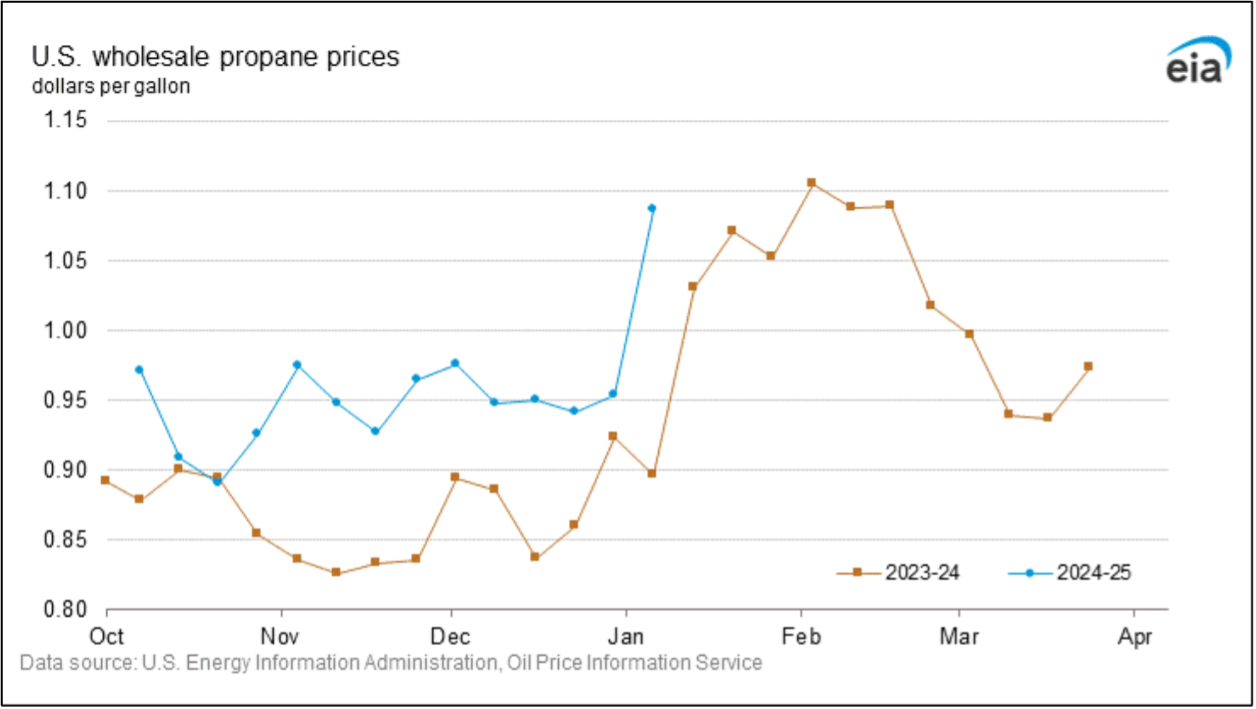

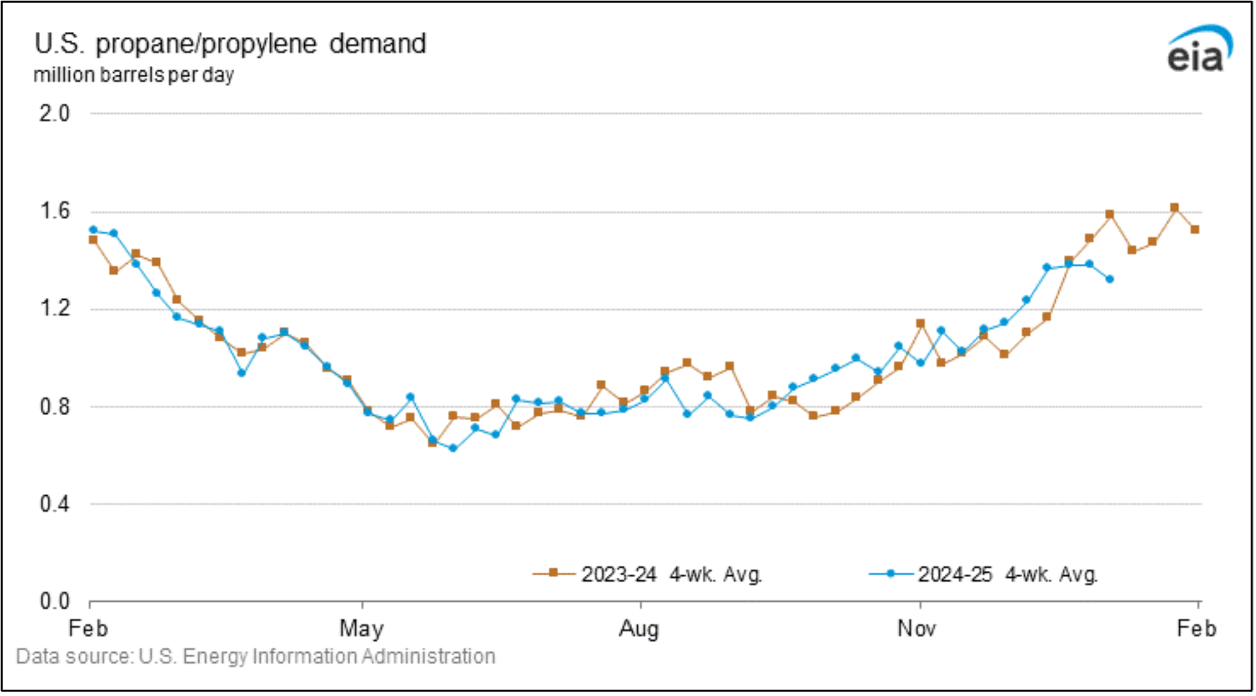

U.S. propane prices are certainly affected by local markets, but the wholesale component for those prices is still impacted by international supply and demand pressure on crude oil. It seems the current world economy is slowing, especially the Chinese economy, potentially signaling a decreased demand for oil. Less oil production usually means less propane production/supply, supporting a higher price. This could be somewhat offset by increased war demands on petroleum production. Locally, Gulf Coast propane supplies are hovering at the top of the five-year average (Fig. 1). However, wholesale prices are about 20% higher than at the same time last year (Fig 2). Gulf Coast propane production has been steady while overall demand for LP is down currently compared to last year (Fig 3), suggesting lower prices may be on the horizon. What does this mean for the commercial poultry grower reaching the end of his contract allotment? Local market dynamics will likely affect prices more than international supply and demand dynamics for the remainder of winter. If the weather forecast suggests a milder end to winter, it may be prudent to end the season on the cash market as needed, expecting local prices to decrease going into spring rather than signing a late-season contract. Then, wait for the summer booking to prepare for winter 2025-26. However, if a grower can contract additional LP booked for close to their previous contract price, it is usually a good risk management decision to do so. It’s up to the grower to decide when that difference warrants taking the risk.

Natural gas users are typically tied to the current cash price for gas as it is delivered at the meter. Local (U.S.) supply and demand are the primary drivers of NG prices for U.S. consumers, which is greatly affected by weather. Although the South Atlantic region has thus far experienced 59 fewer Heating Degree Days than normal, 26 fewer than last year,temperatures are beginning to fall, leading to local NG prices increasing across the region and nationally. Current US-EIA data shows a 4.7% increase in NG prices for the southern region, with the Henry Hub wholesale price (southeastern source for NG) rising $0.37/MMBtu the week of January 13, 2025 (Fig 4). All of this seems to indicate a rising price for commercial natural gas users for the remainder of this winter season.

As always, it’s never too late to tighten up the leaks and shore up the insulation in the poultry houses. A little savings can go a long way in an increasing fuel price market.

Fig. 1 – Gulf Coast region LP supply is near the high 5-year average (U.S EIA).

Fig. 2 – Wholesale LP prices are approximately 20% higher than this time last year.

Fig. 3 – LP demand is down slightly compared to last year, suggesting lower prices may be on the horizon.

Fig 4. – NG prices at the Henry Hub (southeastern source) are trending higher at the end of the season, mainly due to decreasing temperatures in the region.

Brothers, Dennis. “Short-term Heating Fuel Decisions Facing Commercial Poultry Growers.” Southern Ag Today 5(5.1). January 27, 2025. Permalink