USDA will release the February Cattle on Feed report on Friday, February 21st. It’s following closely on the heels of the cattle inventory report released at the end of January. There are several interesting things to look for in this report, including overall placements, the impact of border restrictions on placements in Texas, and the number of cattle in feedlots.

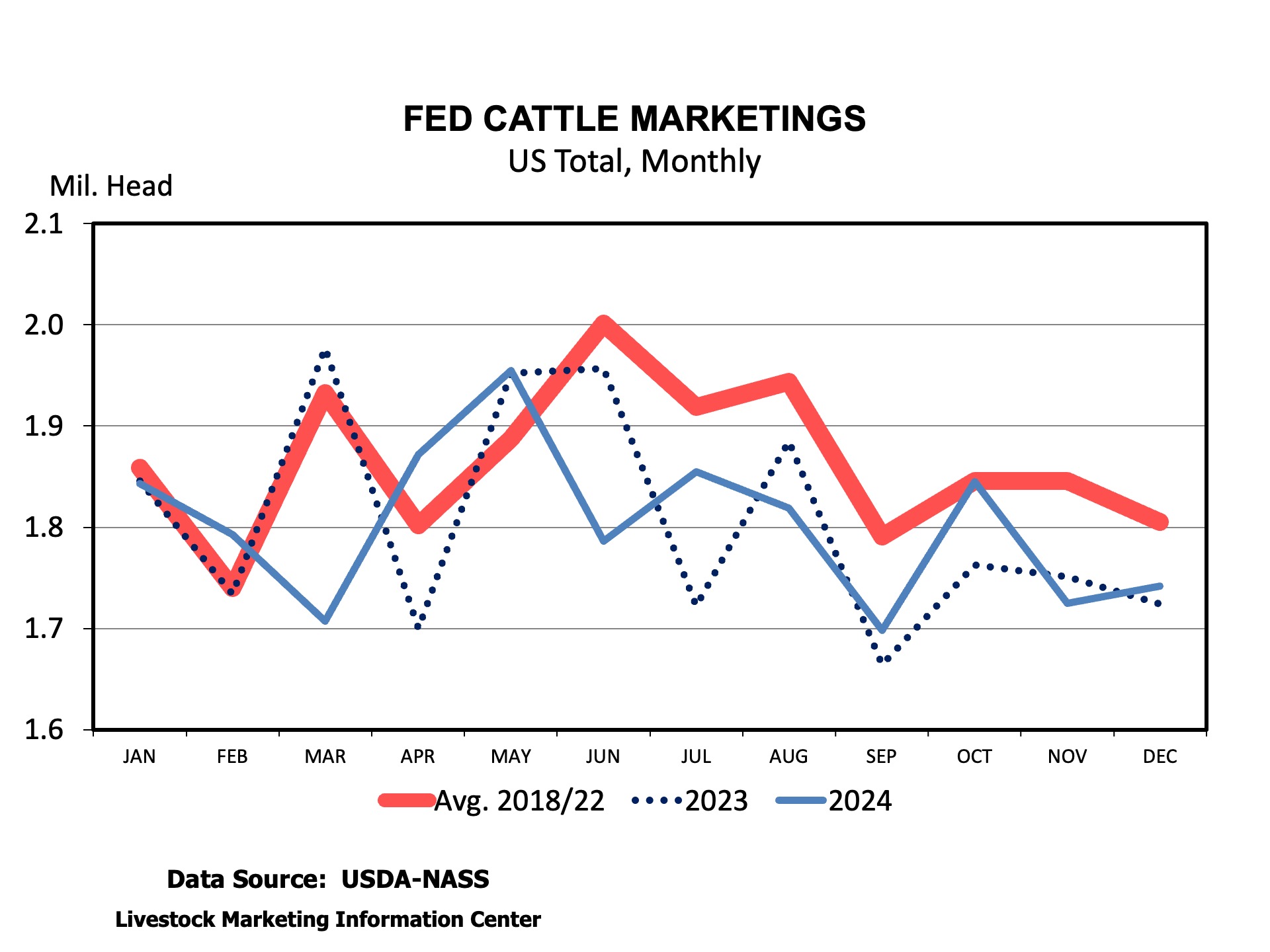

In a sense, marketings and placements are related. We can think of cattle leaving the feedlot for a packer (marketings), making way for new cattle to enter (placements). Marketings are estimated to be up about 2.5 percent in January compared to last January. Given the same number of working days as a year ago, daily average marketings were faster than last year.

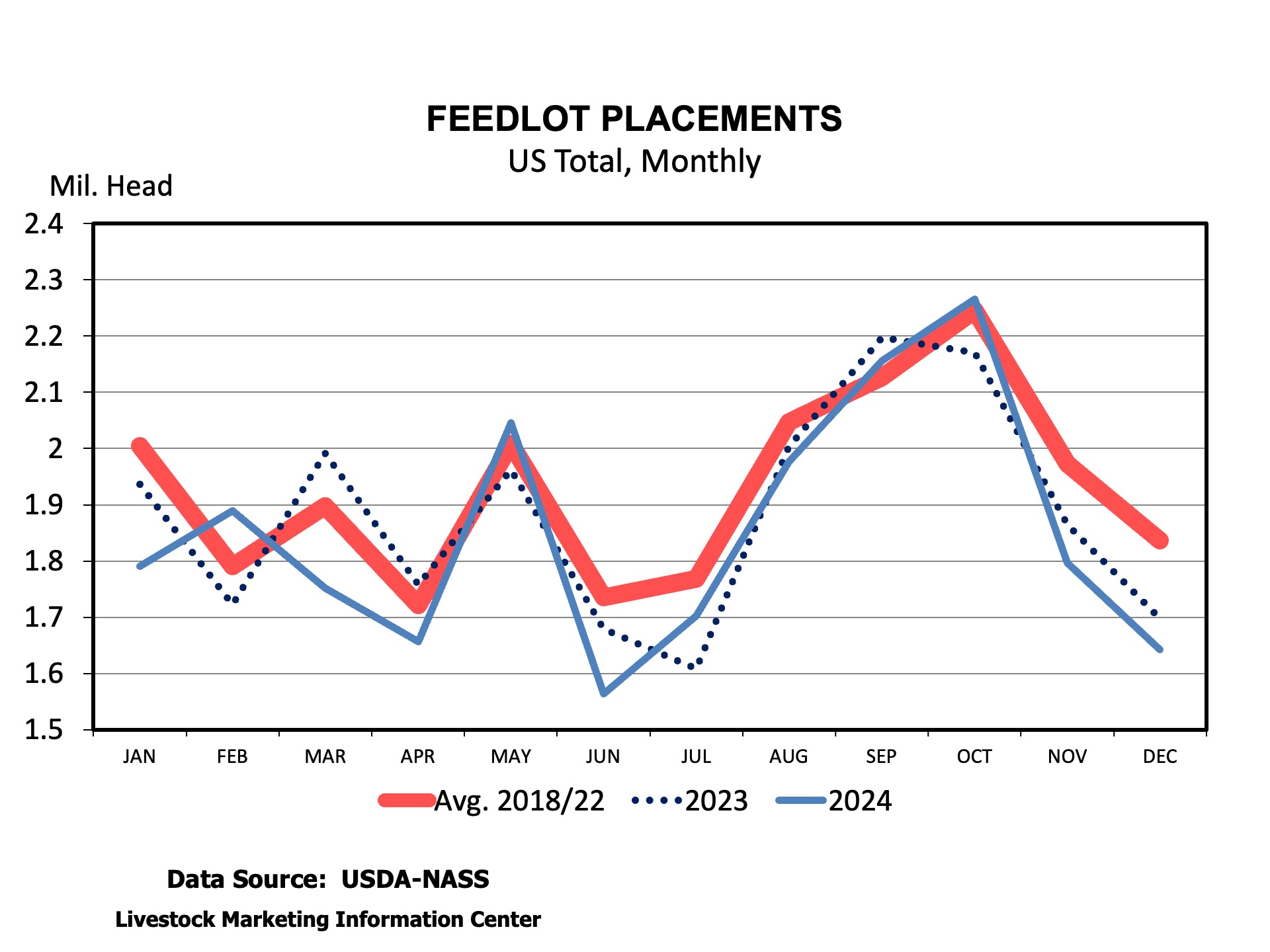

In my pre-report estimates, I expect placements to be about the same as a year ago. Placements equal to last January would imply a fairly small number of feeder cattle placed compared to marketings. This estimate balances larger numbers of feeder cattle in the CME feeder cattle index and no cattle entering the U.S. from Mexico in January. The U.S. imported 107,000 fewer feeder cattle in January 2025. Feeder cattle imports only resumed in the second week of February, at very low levels compared to last year. The number of lightweight placements in Texas will provide some good insight into the impact of the ban on placements. Texas placements in December were down 23 percent, with much of that decline coming in the lightest weight categories.

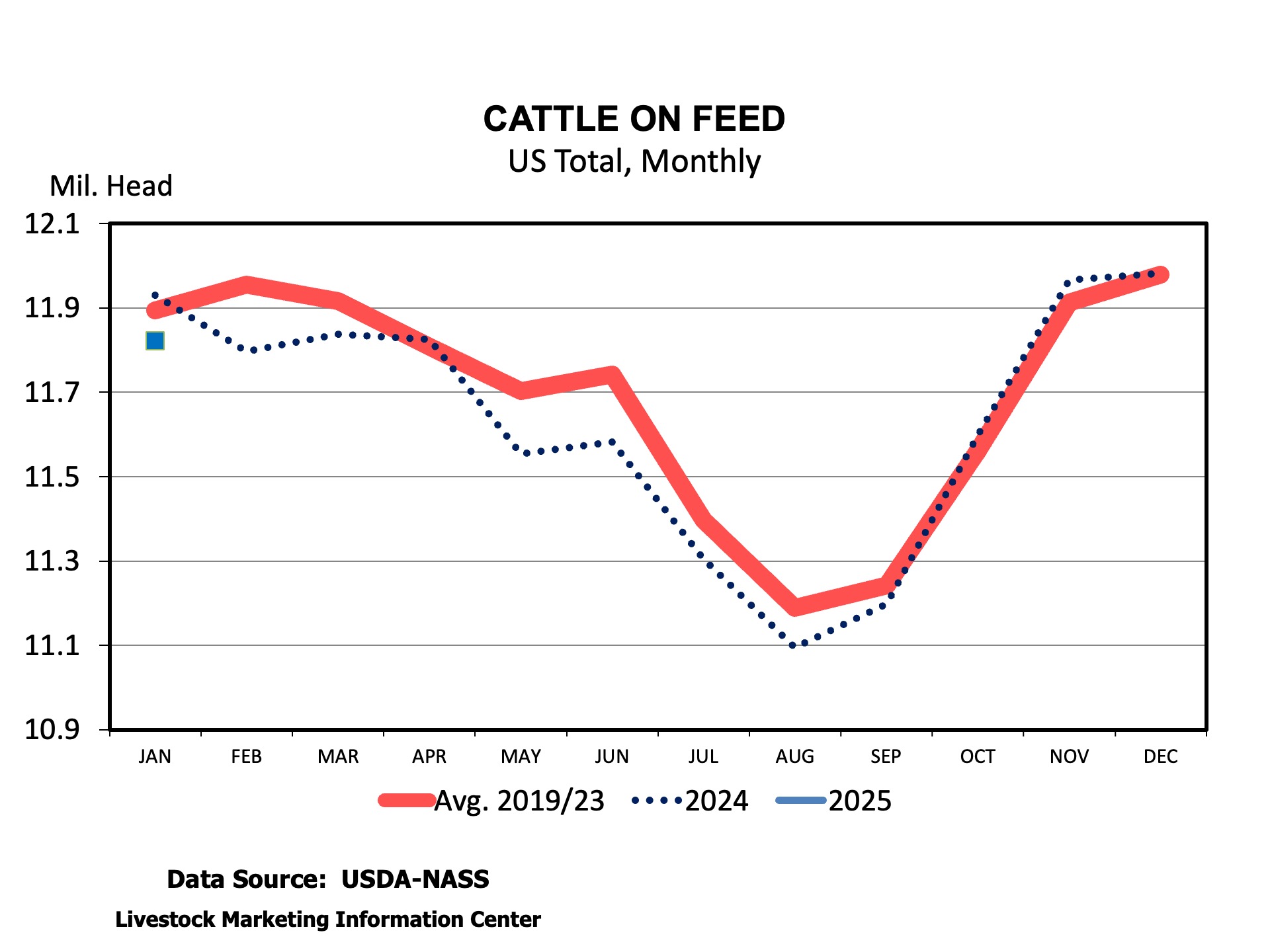

The combination of larger marketings and no change in placements would pull down the number of cattle on feed on February 1st to 98.8 percent of the prior February. Sooner or later, fed cattle supplies will begin to decline dramatically due to fewer calves and herd rebuilding. The market likely can’t continue to rob Peter to pay Paul by pulling animals ahead and placing heifers, and when that ends, the number of cattle on feed will decline dramatically. That will lead to another increase in calf and feeder cattle prices this year.

Two other interesting pieces of information will be included in this report. The February report includes an estimate of total feedlot capacity in the U.S. We often talk about packer capacity but rarely feedlot capacity. Feedlot capacity has not been a limiting factor in the market. This report will also include data on the number of fed cattle marketings and cattle on feed by size of feedlot. That data provides some insight on concentration in the feedlot sector.

Anderson, David. “Fewer Cattle on Feed?” Southern Ag Today 5(8.2). February 18, 2025. Permalink