On January 31, 2025, the White House announced a 25% import tariff on products from Canada and Mexico that was set to take effect on February 1st but was soon after delayed for one month. Before the pause, Canada announced retaliatory tariffs on several agricultural products including peanut butter. Then on February 10th, the White House announced a 25% tariff on aluminum and steel imports, and the European Union responded with a list of products that could be targeted with retaliatory tariffs, also including peanut butter. The recent trade disputes raise the question of how U.S. peanuts could potentially be affected.

While the U.S. only produces about 5% of the world’s peanuts, it exports 14% of the world’s peanuts. In the 2023/2024 marketing year, 22% of the 3.27 million tons of peanuts that the U.S. produced were exported to other countries. In contrast, 58% of U.S. peanuts went to domestic food production. The U.S. also exports significant amounts of processed peanuts, including peanut butter, which totaled over $256 million in the 2023/2024 marketing year. Thus, while export markets are not the largest destination for U.S. peanuts, they are still a significant portion, and the U.S. is a major peanut exporter.

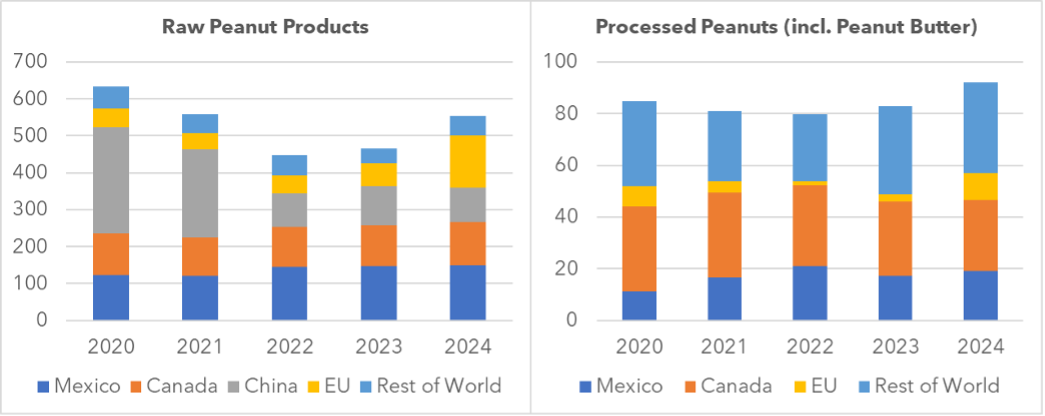

Figure 1 shows the top destinations for U.S. exported peanuts and processed peanut products over the past five marketing years. Mexico has been the top export destination for raw U.S. peanuts each of the past three years, at an average of 147,000 tons of peanuts per year. Canada ranks second over the same period, at 112,000 tons, on average. In the 2023/2024 marketing year, the European Union had a 126% increase in peanut imports from the U.S., totaling 142,000 tons. Lastly, China was the largest peanut export destination from 2019-2021, but has decreased its peanut imports from the U.S. the past three years. Overall, Mexico, Canada, China, and the European Union account for 90% of raw U.S. peanut exports. In contrast, 57% of U.S. processed peanut exports have gone to Canada and Mexico over the past five marketing years. The European Union nearly quadrupled its imports of processed peanut products from the U.S. this past marketing year. In sum, any reduction of U.S. raw or processed peanut exports to Canada, Mexico, and the European Union could present challenges to the U.S. peanut industry.

Figure 1: U.S. Peanut Exports by Destination, Form, and Marketing Year (thousand tons)

Note: Marketing years shown are the ending year (Aug through July)

Sawadgo, Wendiam. “How Might Trade Disputes Affect the U.S. Peanut Industry?” Southern Ag Today 5(8.3). February 19, 2025. Permalink