Timber Market Update

The average south-wide stumpage prices for most major timber products remained relatively unchanged in Q1 2025, staying flat or trending slightly downward. Pine sawtimber averaged around $25/ton, slightly below the price a year ago and about 10% lower than its recent high in Q1 2022 (TimberMart-South, 2025). Pine chip-n-saw prices continued to decline, averaging around $17-18/ton, down about 10% year-over-year and 18% below their 2022 peak. Over the past two years, the average pine and hardwood pulpwood prices have stabilized around $7–8/ton, falling from early 2022 highs. One exception is hardwood sawtimber. Its price held better than other timber products, reaching a record high ($35/ton) in Q4 2024 before a modest retreat in Q1 2025.

While overall changes in south-wide averages are minimal, stumpage prices across the region vary greatly by state and subregion, largely depending on local weather conditions, local mill demand, and post-disaster salvage activities. Compared to a year ago, pine sawtimber prices fell sharply in Florida (-25%), declined moderately in South Georgia (-11%) and Louisiana (-8%), but remained stable in Alabama, Arkansas, North Georgia, and Mississippi.

A Closer Look at the Southern Timber Markets

Generally, weak pine sawtimber prices are mainly due to the sluggish housing market. Over 70% of the U.S. softwood lumber and structural panels are used in residential construction, especially in single-family homes, and home improvement activities (Alderman, 2022). Although newly built single-family houses now make up a significantly larger share of for-sale inventory than before the pandemic, their overall supply remains limited. Contributing factors include rising construction material costs, labor shortages, higher financing costs, restrictive zoning regulation, an increase in existing homes for sale (the highest in five years), and declining housing affordability. Uncertainty around tariffs and immigration policy further discourages expansion for homebuilders. In April, single-family housing starts fell to a seasonally adjusted annual rate of 927,000, down 12% from the previous year and the lowest level since July 2024. A slowdown in remodeling and repair activity has also contributed to softer demand for lumber and timber products (JCHS, 2025).

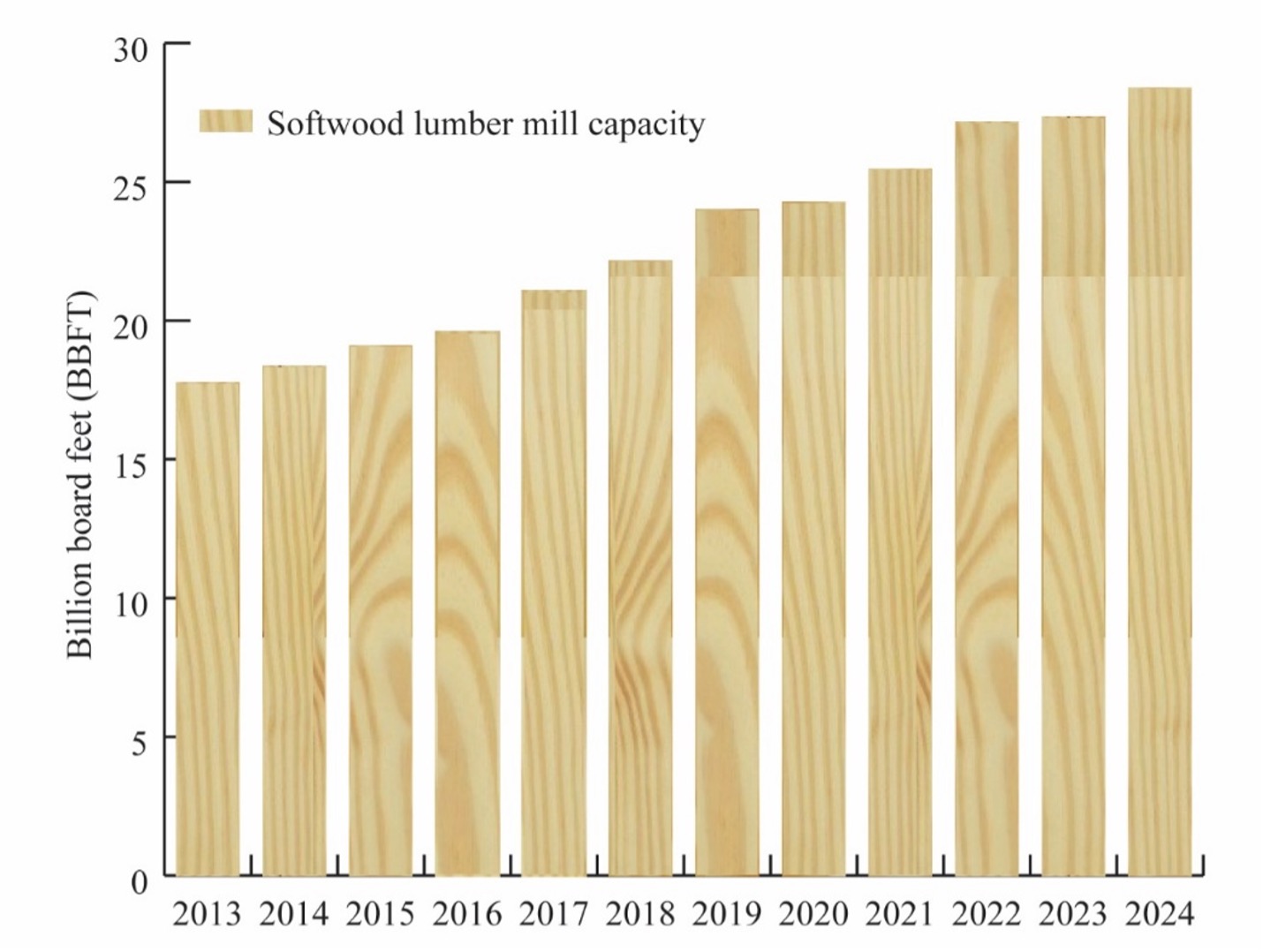

Despite weak demand, southern softwood lumber mill capacity continues to grow, exceeding 28.4 billion board feet in 2024— a 35% increase from 2017 (Figure 1)—with an additional 753 million board feet by 2026 (Forisk, 2025). Much of this expansion is driven by Canadian lumber companies facing reduced log availability in Western Canada and ongoing U.S. tariffs. The combination of this increased capacity, while current production aligns with weak demand, means lower capacity utilization. Utilization rates of southern softwood lumber mills have declined from 85% in 2021 (Forisk, 2023) to 75% in 2024 due to softer lumber demand (Forisk, 2025; SFPA, 2025).

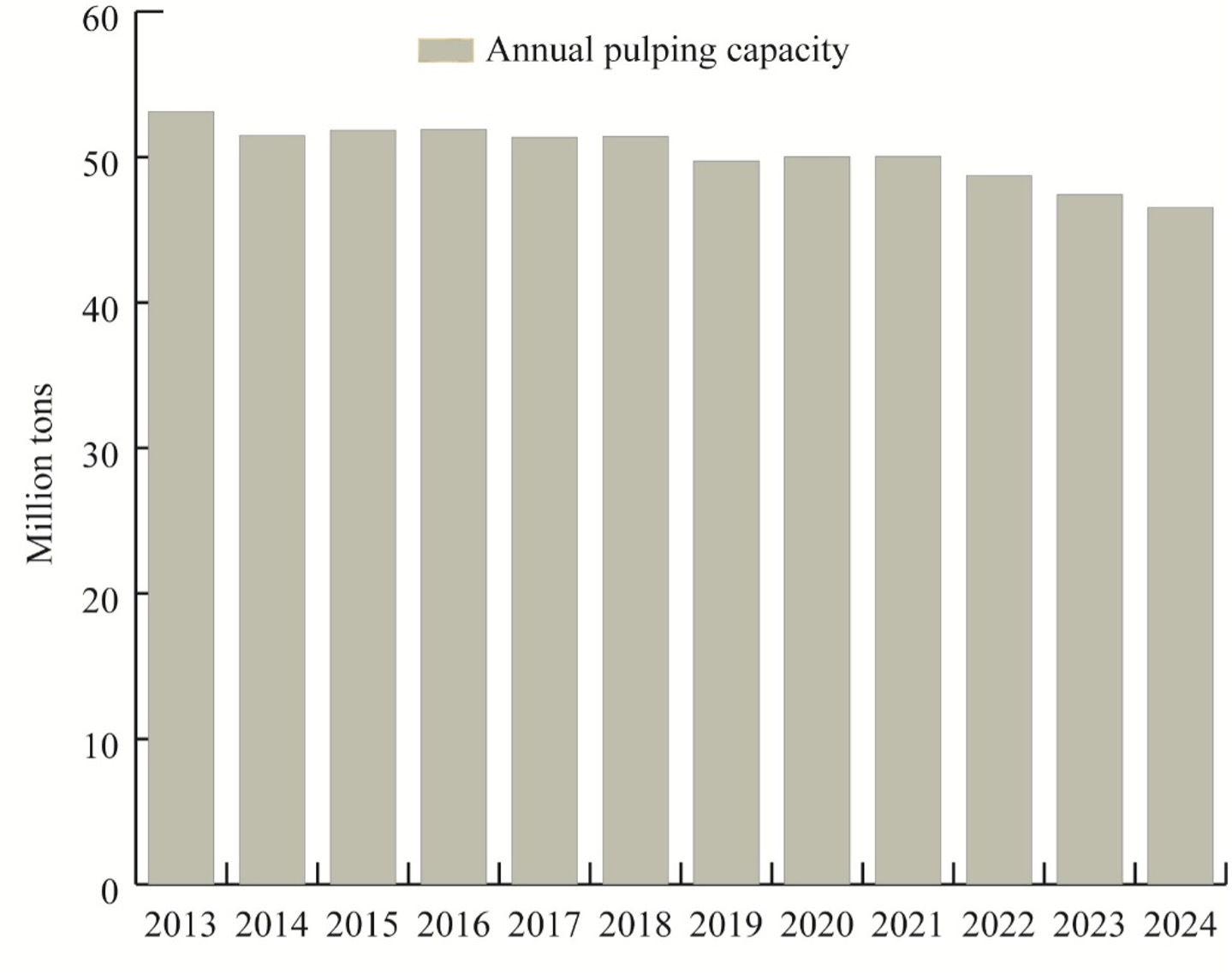

The decline in softwood and hardwood pulpwood prices reflects the continued closure and conversion of wood pulping mills in the South. In 2024, wood-using pulping capacity in the South continued to shrink, driven by product shifts in the paper and paperboard industries and the increased use of recycled fiber in pulp production (Figure 2). These structural changes are expected to keep pulpwood prices suppressed, especially in areas impacted by Hurricane Helene and recent paper mill closures.

Figure 1. U.S. South Softwood Lumber Mill Capacity, 2013-2024

Figure 2. U.S. South Wood-using Pulping Capacity, 2013-2024

Figure 3. Added Softwood Lumber Mill Capacity by State, 2017-2025

Looking Ahead

As a leading indicator, single-family housing permits declined by 5.1% in April to an annualized rate of 922,000 units, 6.2% lower than the same time last year. Housing starts are expected to remain weak through the remainder of 2025. This downward pressure, combined with a lingering oversupply of sawtimber from a decade of underbuilding, is expected to weigh on southern timber markets.

The tariff on softwood lumber imports from Canada currently remains at 14.5% but is expected to increase in fall 2025 (NAHB, 2025). Higher tariffs may reduce Canadian lumber imports and promote U.S. domestic production over the long term. However, they could drive up construction costs in the short term, exacerbating already low housing affordability.

Areas that have a recent expansion in mill capacity may see localized increases in sawtimber prices (Figure 3). Counties devastated by Hurricane Helene (e.g., South Georgia) may face tighter timber supply and rising sawtimber prices due to local inventory shortages, particularly in areas with low growth-to-drain ratios (USDA Forest Service, 2024).

References

Alderman, D. 2022. U.S. forest products annual market review and prospects, 2015-2021. General Technical Report FPL-GTR-289. Madison, WI: USDA Forest Service, Forest Products Laboratory.

Forisk. 2023. Regional forest product mill utilization. Athens, GA: Forisk.

Forisk. 2025. Forisk North American forest industry capacity database. Athens, GA: Forisk.

Joint Center for Housing Studies of Harvard University (JCHS). 2025. Leading Indicator of Remodeling Activity (LIRA). Cambridge, MA: Joint Center for Housing Studies of Harvard University.

National Association of Home builders (NAHB). 2025. In win for NAHB, Canadian lumber exempt from Trump’s global reciprocal tariffs.

The Southern Forest Products Association (SFPA). 2025. Lumber shorts. Metairie, LA: SFPA.

TimberMart-South. 2025. Market news quarterly. Athens, GA: TMS.

USDA Forest Service. 2024. Forest Inventory Analysis Program Forest Inventory EVALIDator web-application. St. Paul, MN: USDA Forest Service, Northern Research Station.

Li, Yanshu. “Timber Market Remains Sluggish Amid Weakened Housing Starts.“ Southern Ag Today 5(27.1). June 30, 2025. Permalink