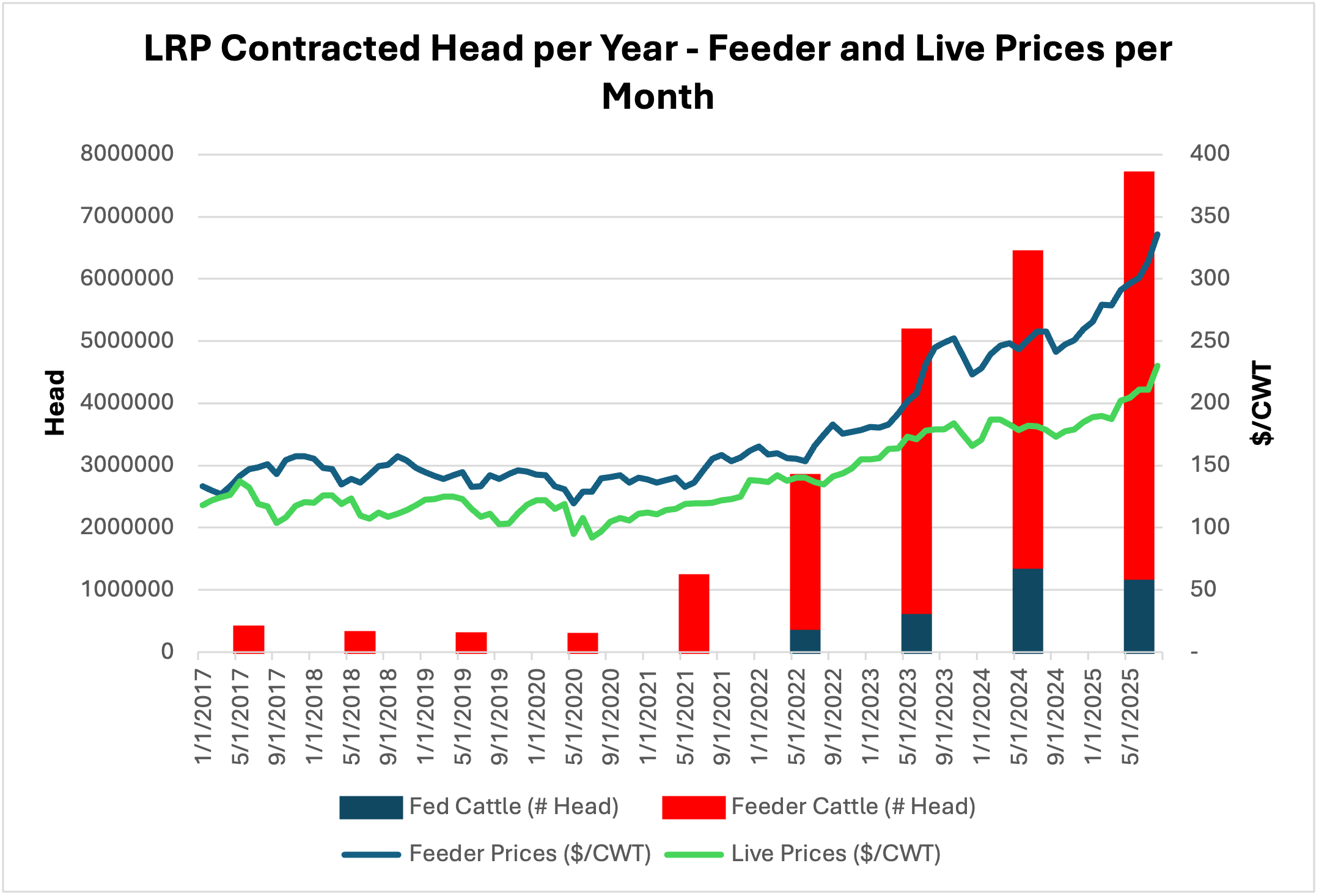

Producers across the United States, particularly in the Southern states, are increasingly adopting the Livestock Risk Protection Program (LRP) despite a strong market and high premiums. Originally designed to protect ranchers against declining cattle prices, the LRP has experienced significant growth. The number of head covered under the program has increased from just 71,000 in 2017 to 7.5 million by July 2025. In 2024, ranchers insured prices for 6.2 million head, a notable increase from 4.97 million in 2023. This increase corresponds with changes made to the LRP program by the USDA and the substantial improvement in market prices for feeder and live cattle (see Figure 1).

The increase in cattle prices, coupled with the narrowing margins for stockers and feedlot operations, highlights the need to implement effective price risk management strategies. The LRP helps minimize financial losses, secure profit margins, and reduce the risk of business failure, especially considering higher investment levels. The higher adoption of the LRP indicates a growing number of ranchers are integrating price risk management plans to protect their operations. By establishing a floor price for their cattle, these ranchers significantly lower the risk of business failure.

Figure 1: LRP Usage and Prices

In the summers of 2019 and 2021, the USDA implemented several modifications to the Livestock Risk Protection (LRP) program that contributed to this growth. These changes not only reduced the premiums ranchers had to pay but also allowed them to defer premium payments until the end of the endorsement period, making the program more accessible across all states and counties.

While LRP can be used to hedge many beef cattle categories, not every LRP animal category has increased at the same rate. Steer Weight 2 is the most commonly used category for price hedging. This category had an average weight of 854 pounds per head insured. So far in 2025, this category accounts for 42% of all transactions, which is slightly below the historical average of 46%. The second and third largest categories are Fed Cattle Steers & Heifers, which have a historical average weight of 1,480 pounds per insured head, and Heifers Weight 2, which have a historical average weight of 826 pounds. These two categories account for 20% and 17% of the historical transactions, respectively.

Remarkably, the Unborn category has experienced significant growth this year. Unborn cattle represent 11% of the total number of head insured, well above the historical average of 6%. Historically, the Steers and heifers Category 1, including the Unborn category, accounts for 17% of all head insured. This past year, that proportion increased to 22%, thanks to the growth in unborn cattle.

Figure 2: Beef LRP Usage per Animal Category

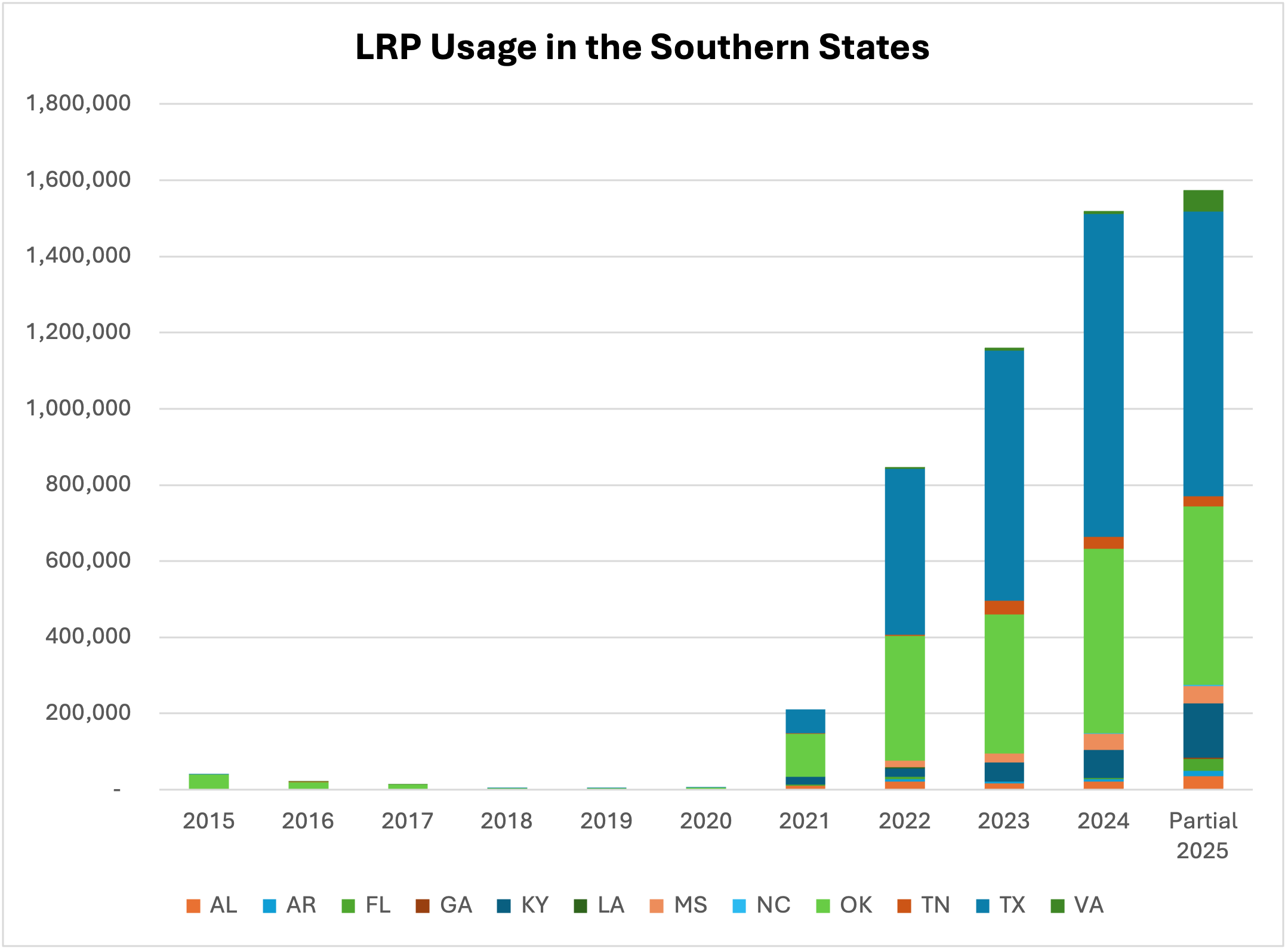

Ranchers in the Southern region have also increasingly adopted the Livestock Risk Protection (LRP) program as an essential tool for managing price risks over the past five years (see Figure 3). As of July 2025, ranchers insured approximately 1.3 million head of cattle annually through the LRP program, with Texas and Oklahoma accounting for 47% and 30% of the total, respectively. However, in the past year, participation from Texas and Oklahoma has decreased compared to other Southern states. So far in 2025, these two states represent 77% of the total head insured in the Southern region, down from 88% participation in 2024.

Figure 3: LRP Usage in the Southern States

For more information on the LRP, consult the USDA Fact Sheet on Livestock Risk Protection for Fed Cattle. If you’re considering purchasing price insurance through this program, you can find a list of approved livestock agents and insurance companies on the USDA website.

Abello, Pancho. “USDA’s Livestock Risk Protection Program Use Keeps Increasing.” Southern Ag Today 5(33.1). August 11, 2025. Permalink