Authors: Hudu Abukari, Kevin Kim, Ayoung Kim, and Brian Mills

Agricultural and forest land are essential components of the rural economy throughout the southern United States. These lands support crop and livestock production, timber, recreational uses, and long-term investment opportunities. As regional demand for agricultural land continues to evolve, understanding who is buying land and how land-use patterns are shifting is increasingly important for producers, lenders, Extension agents, and policymakers.

In our previous Southern Ag Today article, we showed that individuals and general partnerships (GPs) remain the most active participants in the farmland market in terms of transaction frequency. However, there was an increase in the number of non-individual/non-GP buyers, particularly financial and real estate developers. In this publication, we dig deeper into more specific land types and buyer trends across southern states.

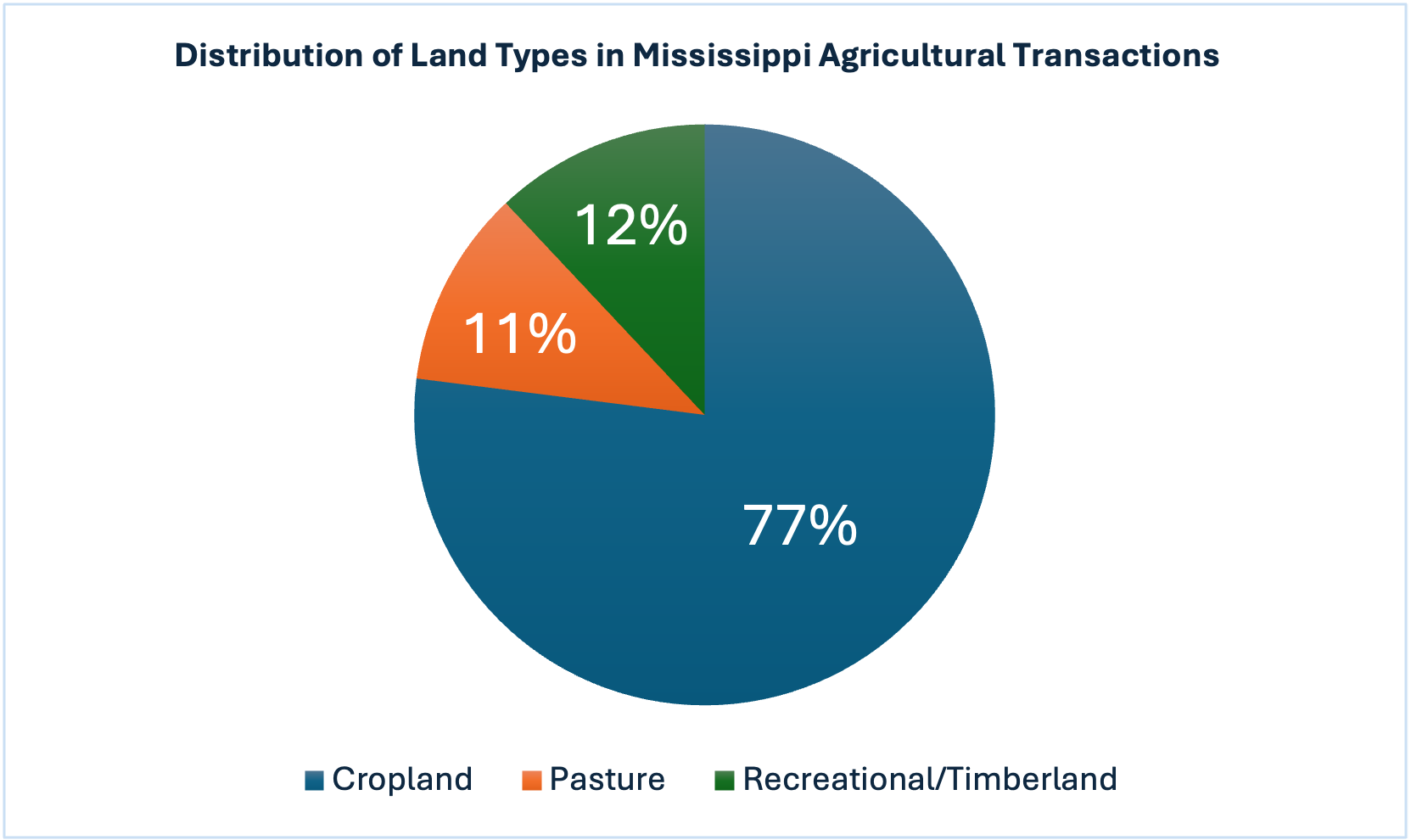

The majority of land transactions involve recreational/timberland, which accounted for 77% of all agricultural land purchases between 2019 and early 2023. Timberland dominates the rural landscape in many parts of the South, and its large share of transactions reflects its availability and investment appeal. In contrast, cropland represented only 11% of agricultural land transactions, while pasture made up the remaining portion in terms of transactions. This difference highlights a key challenge in many southern markets: cropland and pasture turnover is relatively low, while timber and mixed timber-recreational tracts are far more commonly available.

Types of Buyers Participating in Different Agricultural Land Market

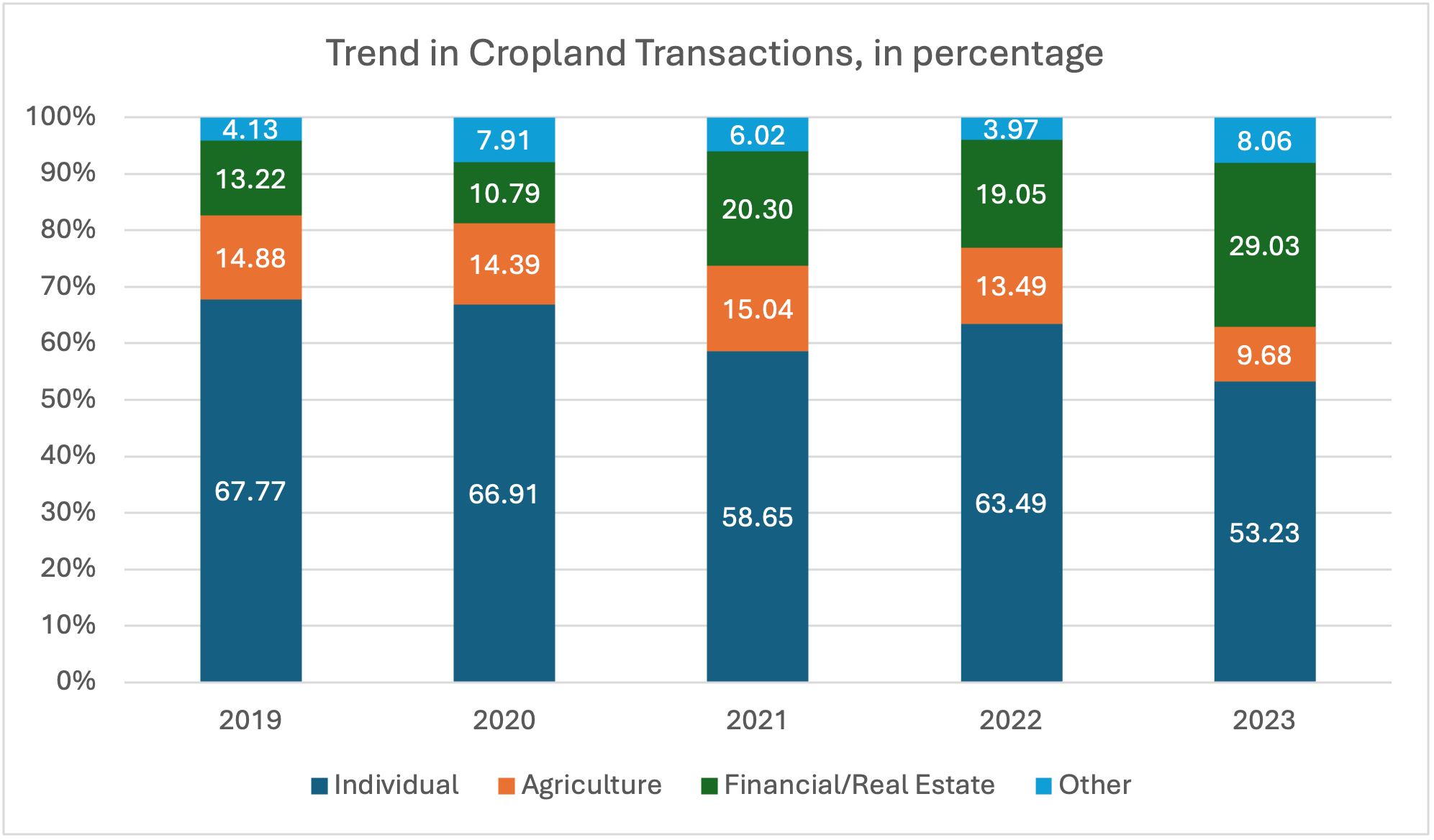

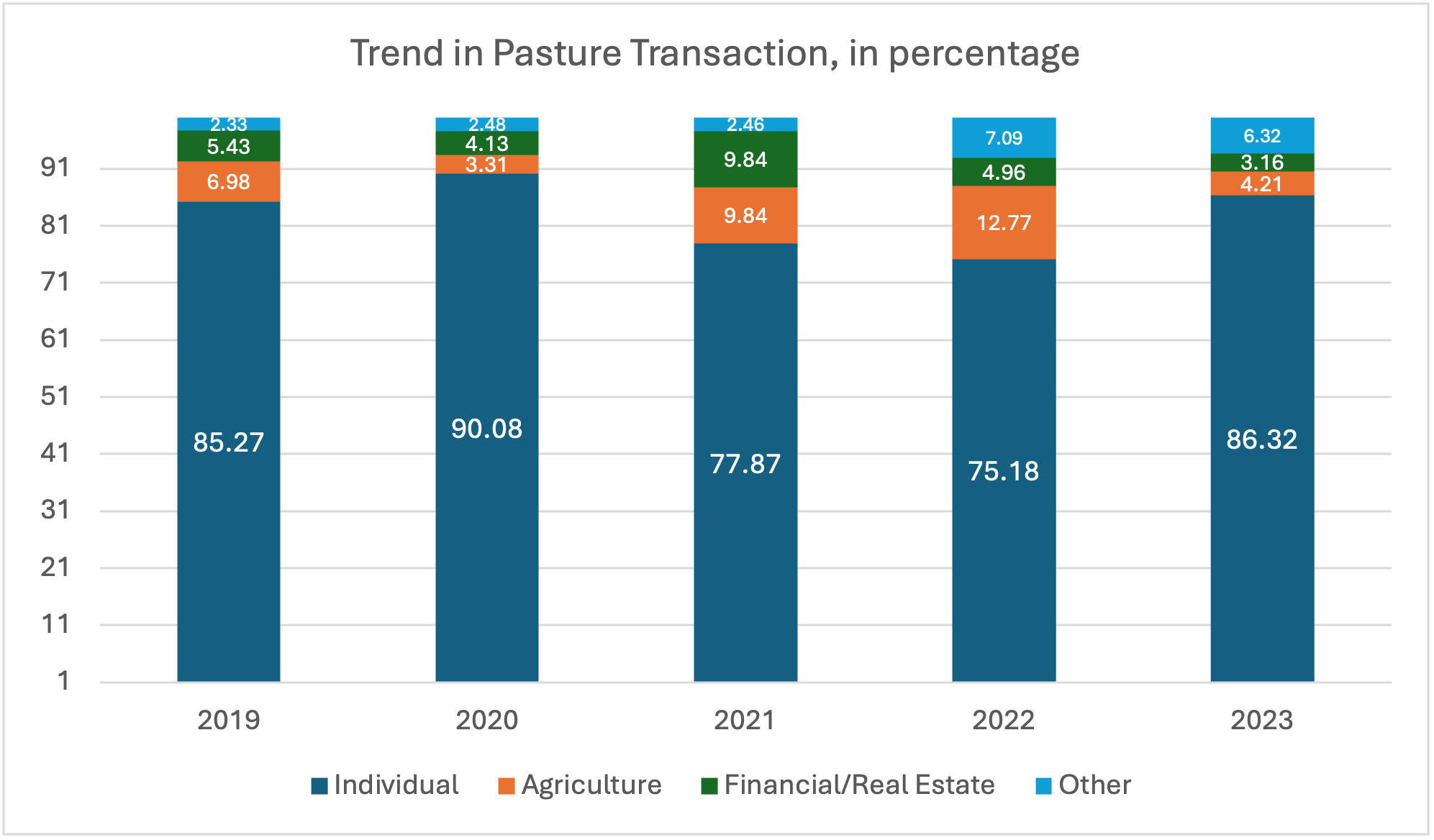

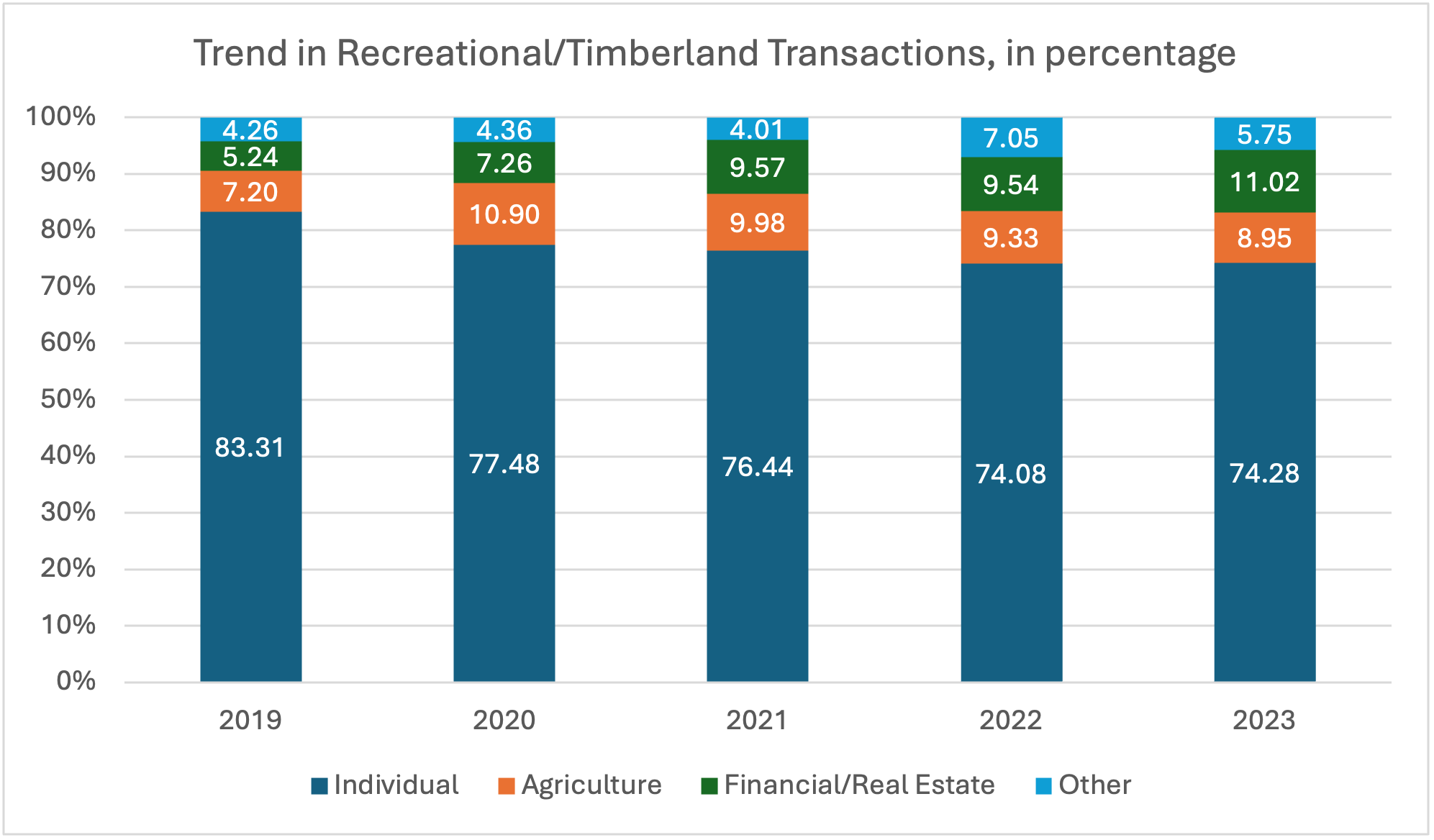

Buyers of agricultural property generally fall into four categories: (1) Individuals and general partnerships (GPs); (2) Non-individual/non-GP agricultural businesses; (3) Financial and real estate businesses; and (4) Other industries. A closer look shows distinct differences in buyer behavior across cropland, pasture, and recreational/timberland.

Cropland

Pasture

Recreational/Timberland

Overall Market Shifts and Implications

The most significant trend is the growing presence of financial and real estate businesses, particularly in cropland and recreation/timberland.

- Cropland has the most diversified buyer pool, and shows the most notable shift toward investor participation displacing individuals and agriculture businesses. From 2019 to 2023, the presence of financial and real estate investors rose from 13% to nearly 30%.

- Pasture remains the most stable and producer-driven category, reflecting the long-term nature of livestock operations and the prevalence of family ranching across the southern region.

- Recreational and Timberland buyers are still dominated by individuals, but the less traditional buyers have made modest gains in market share. Notably, the share of financial and real estate developers has doubled over the period.

These trends bring some opportunities, such as new capital entering rural land markets, increased land valuation, and potential for diversified land uses. However, possible challenges should be considered, including higher land prices, greater competition for limited cropland, and potential barriers for small, beginning, and socially disadvantaged farmers.

Monitoring these patterns can help Extension professionals, rural leaders, lenders, and policymakers respond proactively to ensure that land markets remain accessible and supportive of agricultural communities.

Abukari, Hudu, Kevin Kim, Ayoung Kim, and Brian Mills. “Who’s Buying Farmland? A Look at Mississippi’s Agricultural Land Markets Part II.” Southern Ag Today 6(2.1). January 5, 2026. Permalink