We ended 2025 examining total meat supplies, so this week we’ll take a closer look at chicken production.

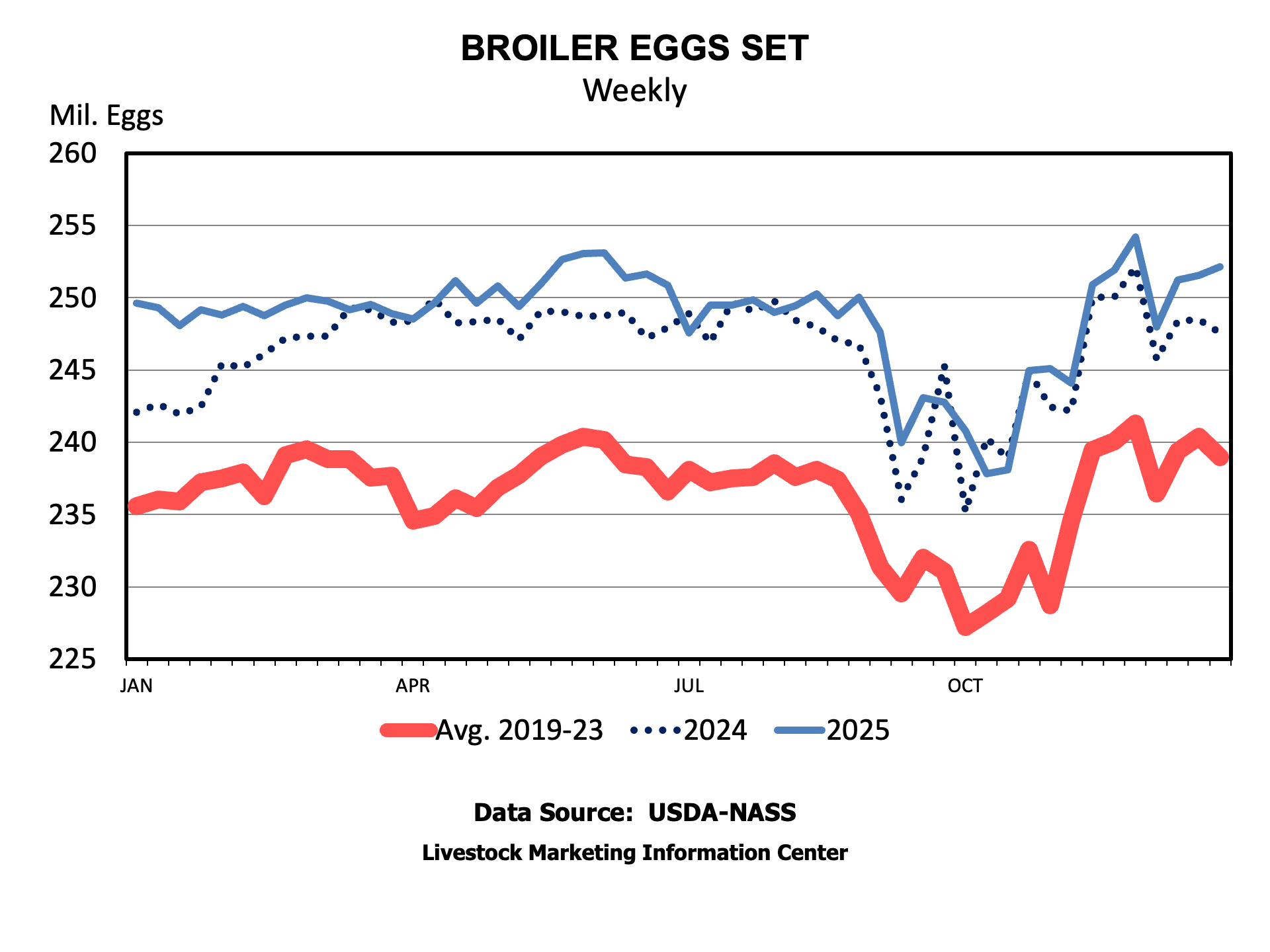

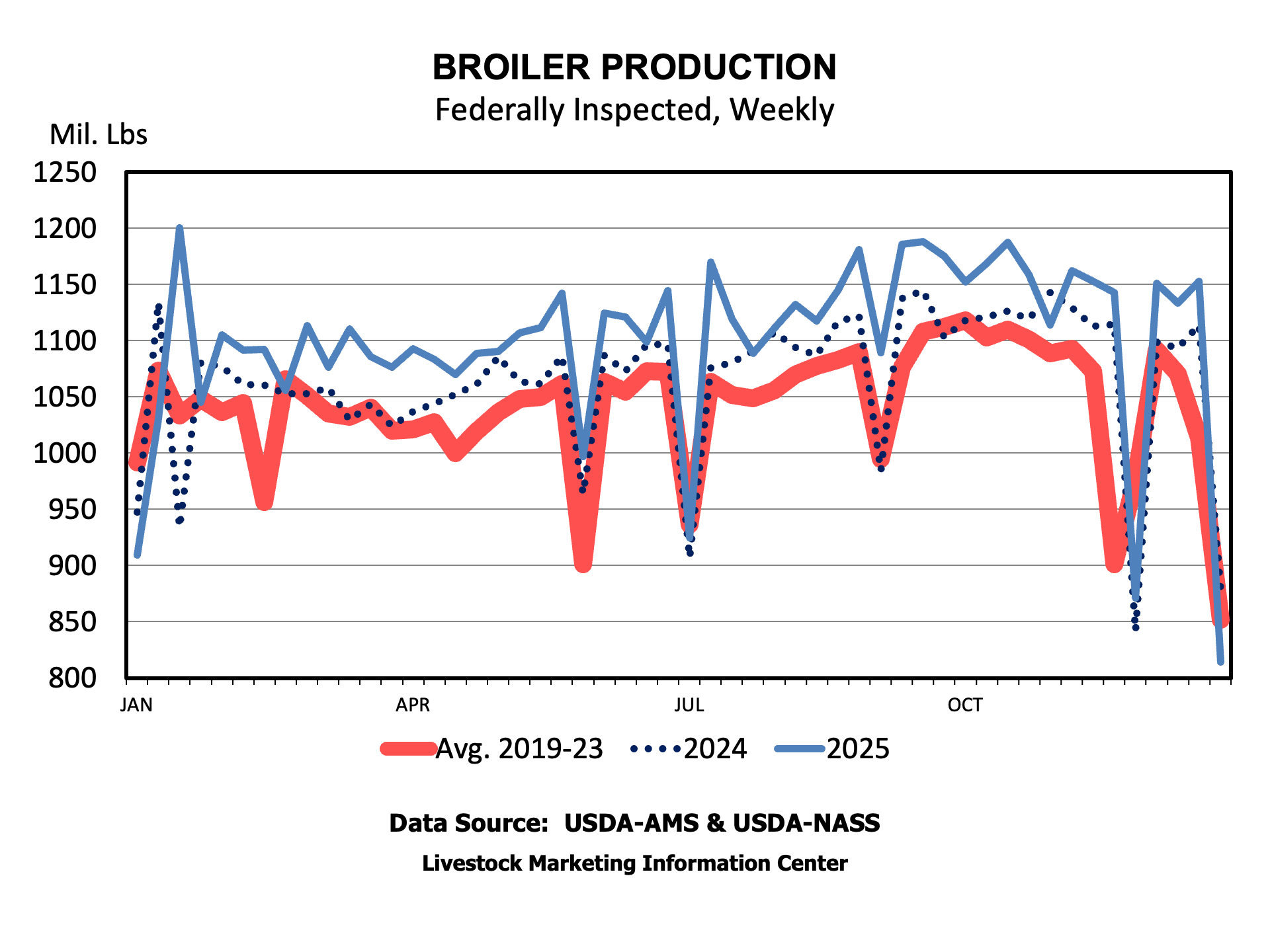

If the reader will forgive the obvious joke about what comes first, 1 percent more eggs for broiler grow-out were set in 2025 compared to 2024. That led to about 1 percent more chicks placed. A few more broilers made it from placement to slaughter, leading to broiler slaughter growing by 2.1 percent over the prior year. Combining more slaughter with 1.2 percent growth in weights generated a 3.3 percent increase in broiler production in 2025.

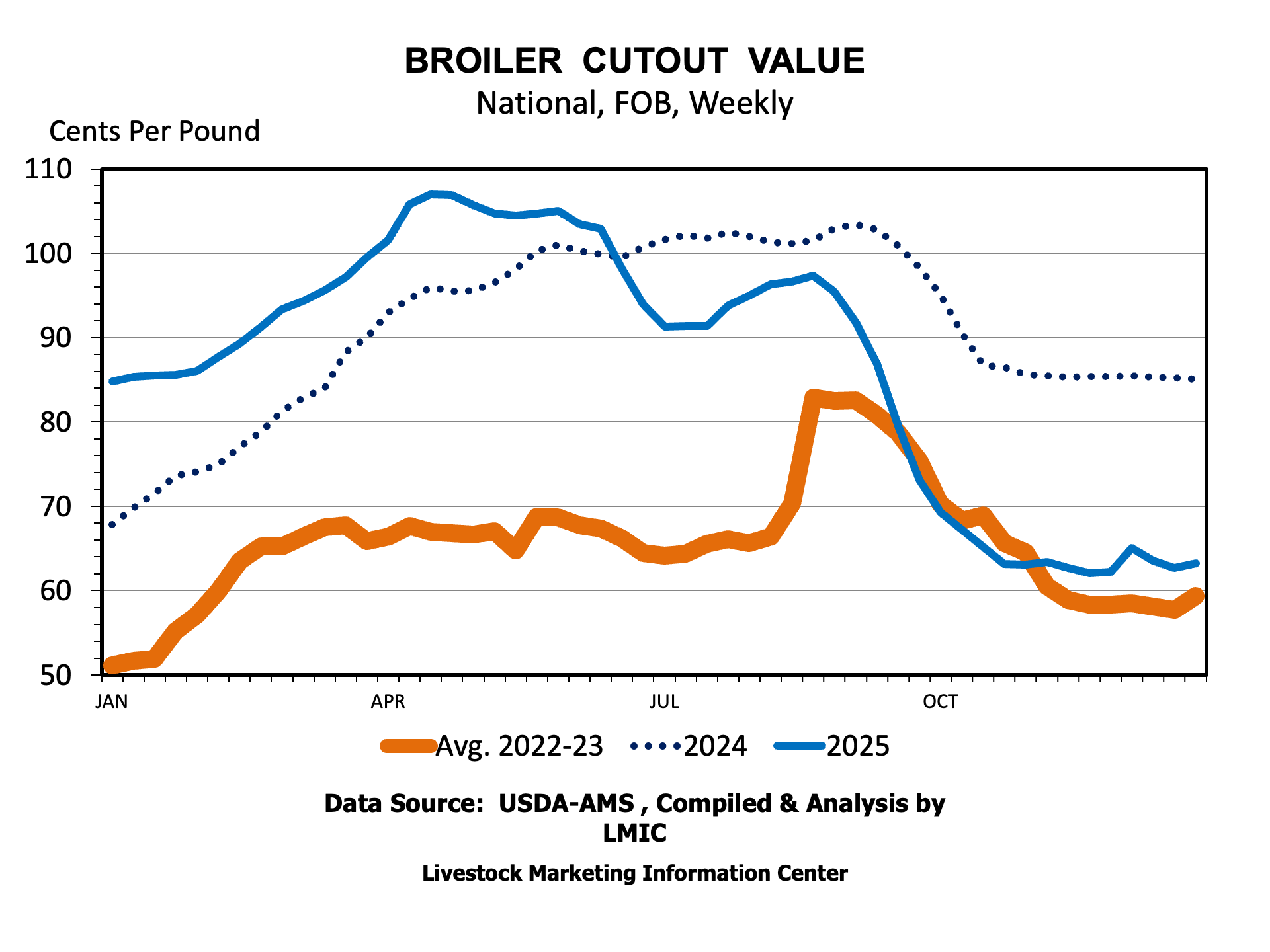

Increasing broiler production was jump started by profits from the combination of high broiler meat prices and falling feed costs. Broilers have a cutout value calculated, much like beef and pork. The broiler cutout value increased from $0.85 per pound in January 2025 to a peak of $1.07 per pound by May. The peak value was about 12 cents per pound higher than the same point the year before and 62 percent higher than the 5-year average for the same period. High prices in 2025 are built on higher price levels hit in 2024. The cutout dropped rapidly later in 2025. By the end of December, the cutout was down to $0.63 per pound.

The decline in the cutout value is shown in the wholesale cuts that make up the cutout value. Wholesale boneless, skinless breast meat has declined from a mid-year peak of $2.77 per pound to $1.16 per pound at the end of December, well below the almost $1.50 per pound the year before. Legs have declined from about $0.90 per pound to $0.59 per pound over the same period.

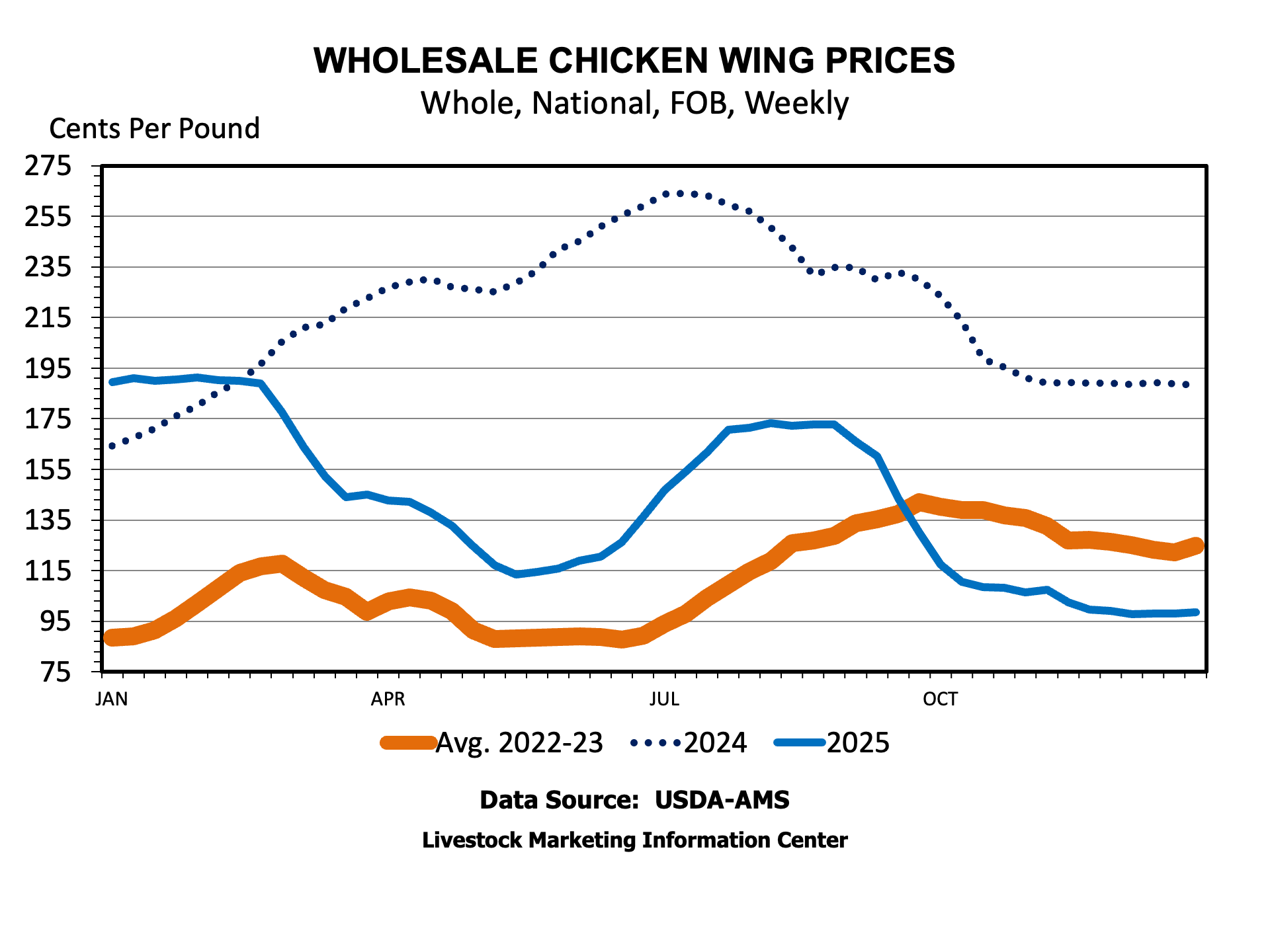

It’s playoff time for the NFL and for college football, and that usually leads to a discussion of chicken wings. It’s often noted that wholesale wing prices tend to increase leading up to the Super Bowl. In 2025, wing prices did increase leading up to the game, but they kept on climbing into mid-year, hitting a peak of $2.64 per pound. By the end of December, wholesale wings were down to $0.98 per pound, almost half the $1.88 per pound at the end of 2024 and lower than the 5-year average price of $1.24 per pound.

Several industry challenges are in place for 2026. The first is lower chicken meat prices, cutting into profits that would fuel more growth. HPAI continues to occur, recently hitting broiler farms and at least one broiler breeder facility. On the positive side, demand for chicken appears to be growing. The latest CPI report indicated that chicken prices declined compared to a year ago, making chicken even more affordable relative to beef. The number of eggs set and chicks placed in December 2025 were up 1.3 percent and 1 percent, respectively, compared to the year before. So, it looks like more broiler production is coming early in 2026.

Anderson, David. “Chicken Production Up and Prices Down.” Southern Ag Today 6(2.2). January 6, 2026. Permalink