USDA released the Cattle inventory survey on Friday, January 30th. We’ve included some thoughts on the report from a few of our Southern Ag Today Livestock Economists.

Kenny Burdine, University of Kentucky.

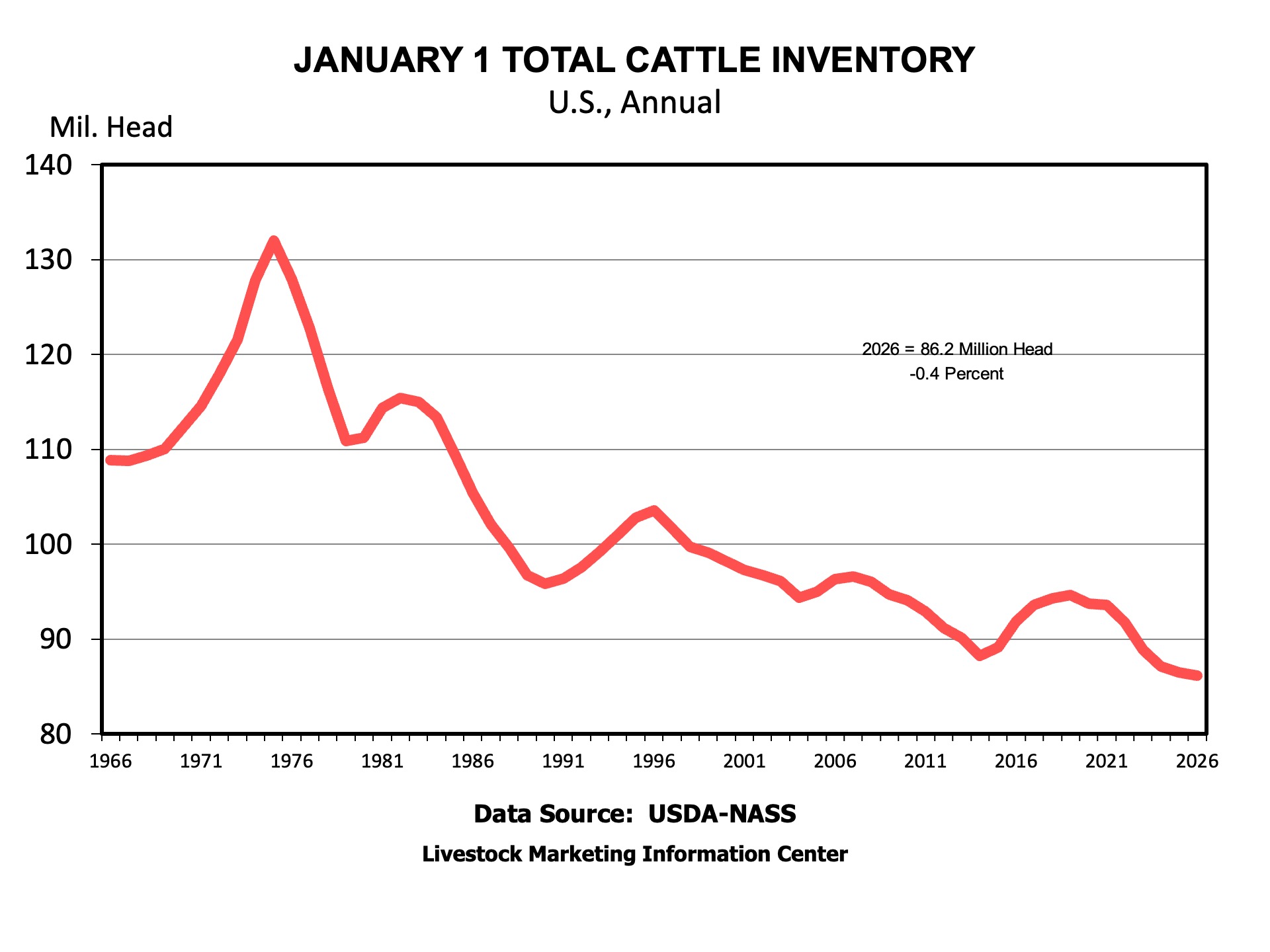

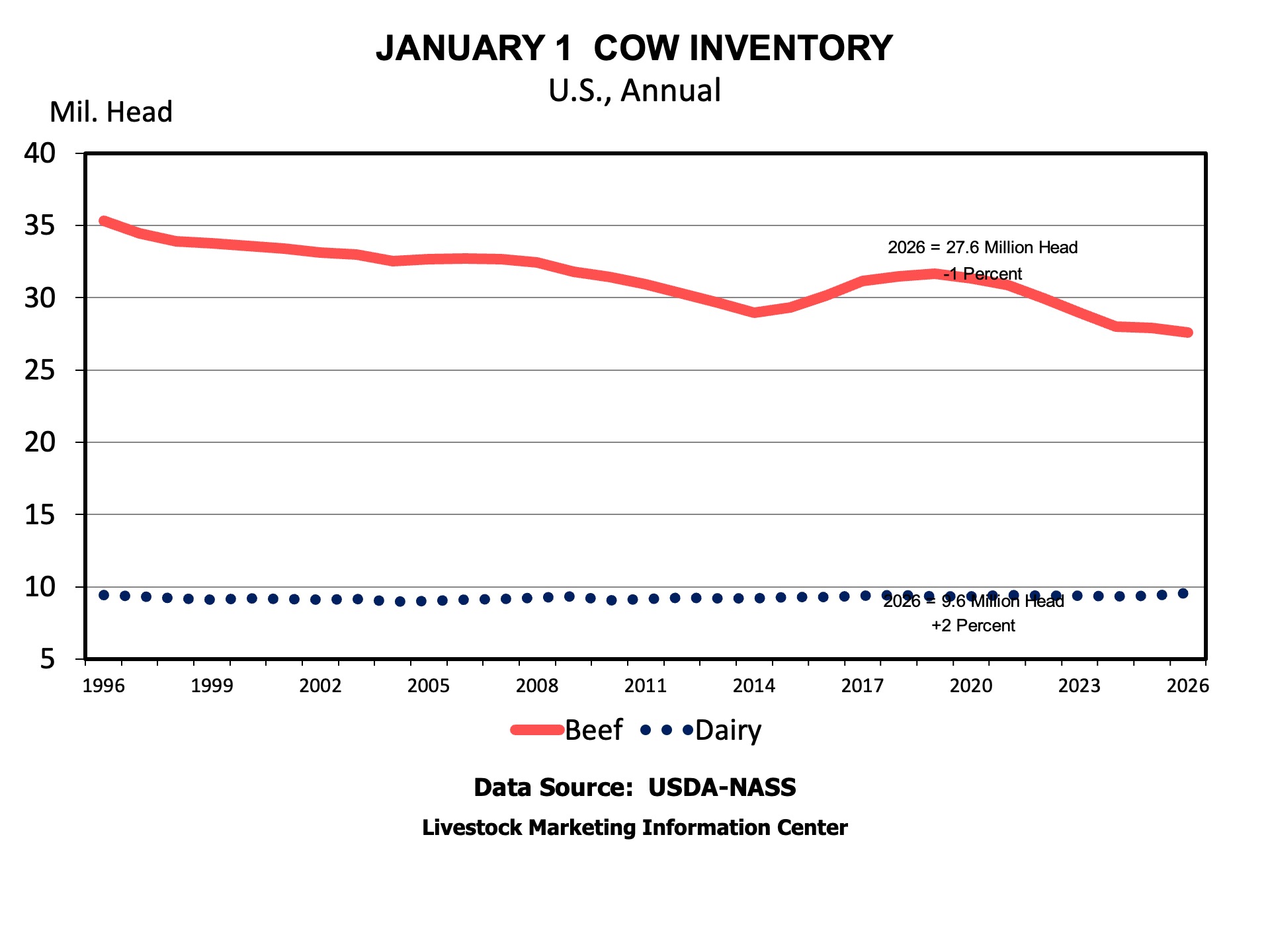

In a word – bullish! The 1% decrease in beef cow inventory surprised me. With beef cow slaughter down by over 500,000 head in 2025, I expected beef cow numbers to be up slightly coming into 2026. At 27.6 million cows, the US beef herd is still at its lowest level since 1961.

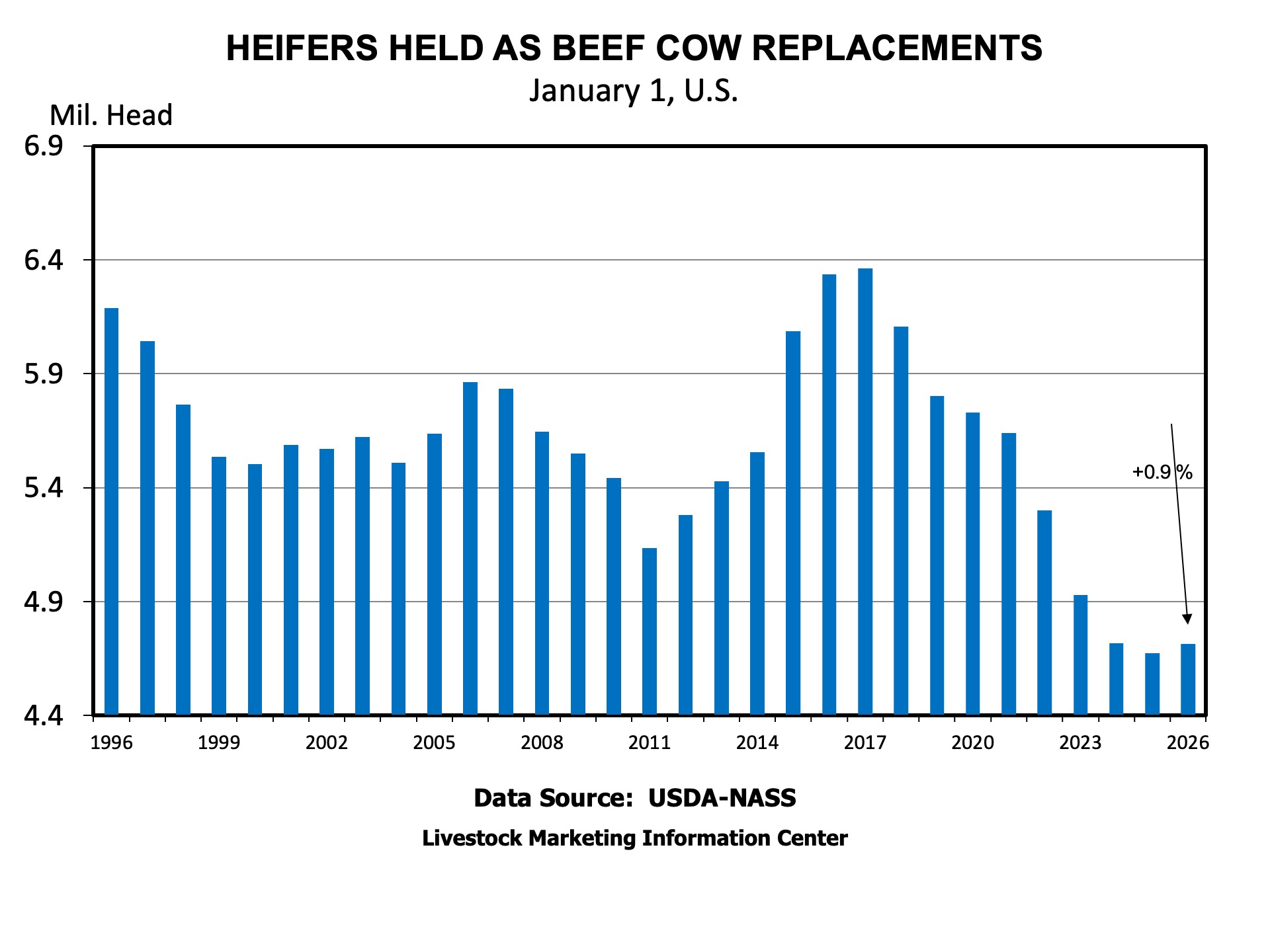

Heifers held for beef cow replacement were estimated at a little over 4.7 million head, which is up 0.9% from last year. I like to consider this number as a percent of beef cow inventory, which would be 17.1%. This is below the long run average, but higher than each of the last 3 January reports.

The 2% increase in dairy cow inventory is also noteworthy. 2024 was a very good year in the dairy sector and cow numbers seemed slow to respond. However, monthly estimates started rising steadily during 2025 and that was reflected in this January 1 number. While milk prices have fallen sharply over the last 12 months, that is likely being offset by strong values for beef-sired dairy calves.

KY beef cow inventory was estimated down another 7,000 (-0.8%) head this year. This is the lowest beef cow numbers have been in the Commonwealth since the 1960’s. In addition to production costs, female values (weaned heifers and cull cows), and interest rates, expansion of the Kentucky cowherd is further constrained by limited pasture availability. A lot of pasture ground was converted to row crops over the last couple of decades.

Andrew Griffith, University of Tennessee.

NASS January 1, 2026 cattle inventory did not perfectly align with industry expert expectations. Frankly, I thought industry experts were a little too ambitious with their numbers before the release of cattle inventory estimates. I am a little surprised more heifers were retained for beef cow replacement than a year ago, but then again, a year ago was a relatively low quantity of animals. As it relates to Tennessee, the values look in line with what was expected, which was a decline in beef cow numbers and heifers held for replacement. Three consecutive Falls have brought drought to Tennessee, which puts a damper on heifer retention.

Hannah Baker, University of Florida.

Some small revisions to the 2025 survey were noted. Revisions to the 2025 data reduced total cattle and calf inventory by 190,000 head, while beef cow numbers increased by 28,500 head. After these revisions, cattle and calf inventory declined by less than 1%, with beef cow numbers down 1% heading into 2026. In Florida however, total cattle inventory increased by 1.3% (20,000 head), with beef cow numbers up 7,000 head (0.8%) and dairy cow numbers up 3,000 head (3.1%). Following a 3,000-head increase in 2025, Florida beef producers appear to be moving toward herd stabilization. Heifers held for beef replacement remained unchanged at 115,000 head. Prolonged statewide drought conditions, recent freezing temperatures, and high calf prices will certainly influence decisions regarding more significant heifer retention in 2026.

Max Runge and Ken Kelley, Auburn University.

Total cattle and calves in Alabama increased slightly for a second consecutive year, even as portions of the state experienced drought. Beef cows that have calved were essentially unchanged from a year ago, while beef replacement heifer numbers increased modestly. At this point, these changes appear to reflect herd stability rather than clear evidence of expansion, and it remains too early to determine whether producers are beginning a broader rebuilding phase.

Will Secor, University of Georgia.

The USDA Cattle report’s headline all cattle and calves inventory was not totally surprising; it showed a slight reduction. However, digging into some of the details reveals interesting shifts. The most interesting national number to me was seeing that the number of beef replacement heifers increased. This is a sign that producers are starting to re-build or at least slow the pace of liquidation. For Georgia, all cattle and calves dropped by around one percent, largely driven by beef cow numbers dropping by around three percent. Milk cow numbers offset those beef cow declines partially, as these increased by five percent. Finally, Georgia’s 2025 calf crop rose by two percent compared to 2024. This higher calf crop came from fewer cows in 2025 compared to 2024 – a potential indication of improved reproductive efficiency for operations in the state.

David Anderson, Texas A&M.

Fewer beef cows but more beef cow replacements, up 50,000 head to 650,000, were noted in the Texas inventory data. Way in the back of the report was the annual estimate of the number of stocker cattle on small grain pastures (wheat, oats, etc.) in Texas, Oklahoma, and Kansas. The report indicated 180,000 more stockers, up 12 percent, than a year ago. That’s interesting given the drought that hurt pasture development, relatively few cattle available, and high prices.

Josh Maples, Mississippi State University.

This report sets up 2026 as another year of tight supplies and provides support for strong prices. The number of heifers held back for beef cow replacements was 4.714 million head, which is a 0.89 percent increase from a year ago. This was on the low end of pre-report estimates. This is the first annual increase in beef heifers in a decade, but still a very low total and not a clear signal of herd expansion. Perhaps this report is a sign of the herd stabilizing as we move into 2026, but more retention will be needed to suggest herd expansion. The bulk of the increased heifer retention occurred in Texas, which added 50,000 heifers for beef cow replacement, while the U.S. overall added 41,700. If more heifer retention occurs in 2026, it will be interesting to track the regional differences in where that growth happens. Total cattle and calves in Mississippi decreased one percent to 800,000 head.

Overall, fewer beef cows will keep supplies tight and prices high in the coming months and the next couple of years.