Authors : Jiyeon Kim, Junior Research Economist- Agricultural Risk Policy Center, North Dakota State University

Andrew Muhammad, Ph.D. Professor and Blasingame Chair of Excellence, University of Tennessee Institute of Agriculture- Department of Agricultural and Resource Economics

In 2025, the President imposed a series of tariffs under the International Emergency Economic Powers Act (IEEPA), reshaping U.S. trade policy. These measures, ranging from fentanyl‑related tariffs in February to broad reciprocal tariffs implemented in April, generated an estimated $130 billion in revenue by early December with implications for multiple sectors, including agriculture. Agricultural inputs such as fertilizer, pesticides, seeds, and farm machinery were subject to these duties, resulting in roughly $1.1 billion in tariff collections between February and November. Although representing small shares of total farm input spending, these tariffs contribute to rising production costs throughout the supply chain (Arita et al., 2026). We provide a brief discussion of these tariffs in this article; a more detailed analysis is presented in IEEPA Fertilizer Tariffs: Revenue, Relief, and Pass‐Through at the following link: https://ageconsearch.umn.edu/record/387621?v=pdf.

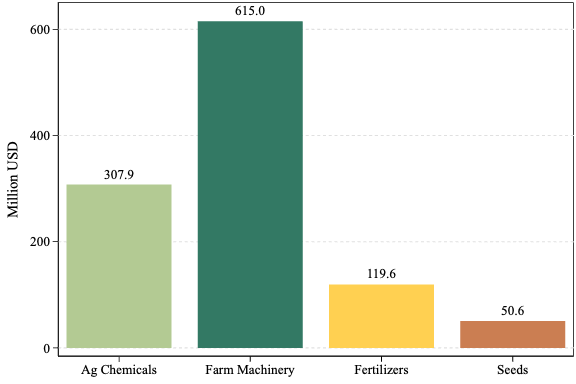

IEEPA tariffs have been imposed on several agricultural inputs including fertilizer, pesticides, seeds, and farm machinery, against a backdrop of already volatile input prices and low commodity prices. Based on import data from the U.S. International Trade Commission and tariff rates specified in executive orders, IEEPA tariff revenue collected on agricultural input imports is estimated at roughly $1.1 billion between February and November 2025 (see Figure 1). To provide some context, USDA projects that U.S. farmers will spend about $27.2 billion on seed, $20.6 billion on pesticides, and $33.5 billion on fertilizers in 2025 (Arita et al., 2026). The tariff revenue collected on these products accounts for approximately 0.2% of seed spending, 1.5% of pesticide costs, and 0.4% of fertilizer costs. Although these shares appear relatively small, they do not fully capture the broader cost pressures facing producers. The tariffs on materials such as steel, aluminum, and machinery components may raise additional costs for U.S producers across the supply chain.

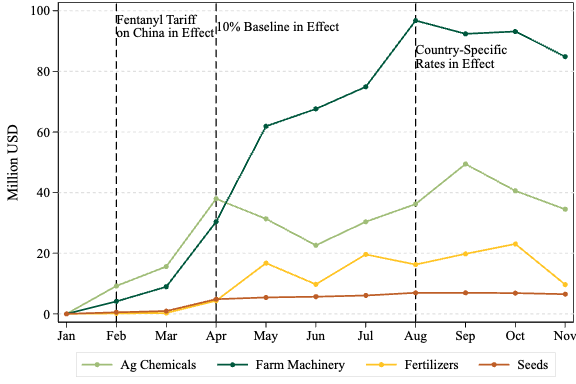

Figure 2 shows the estimated monthly IEEPA tariff revenue by agricultural input category from January through November 2025. While tariff revenue for most agricultural inputs changed modestly, revenue from imported farm machinery rose sharply following the implementation of the 10% baseline tariff in April. This increase was driven primarily by imports from China and India.

Although tariff revenues on key inputs represent a relatively small share of farm expenditures, they contribute to a broader rise in production costs, particularly when combined with duties on steel, aluminum, and machinery components. Continued monitoring is essential as these policies evolve and their cumulative impacts unfold.

Figure 1. Estimated Total IEEPA Tariff Revenue (February-November, 2025)

Figure 2. Estimated Monthly IEEPA Tariff Revenues for Agricultural Inputs in 2025

References

Arita, S., Chakravorty, R., Kim, J., Lwin, W., Steinbach, S., Wang, M., and Zhuang, X. (2026). IEEPA Fertilizer Tariffs: Revenue, Relief, and Pass‐Through. NDSU Agricultural Trade Monitor 2026‐01. Center for Agricultural Policy and Trade Studies, North Dakota State University. January 19, 2026. https://doi.org/10.22004/ag.econ.387621

Kim, Jiyeon, and Andrew Muhammad. “How 2025 IEEPA Tariffs Affected Agricultural Inputs and Production Costs.” Southern Ag Today 6(7.4). February 12, 2026. Permalink http