According to the USDA, U.S. agricultural exports are projected to decline by $2.5 billion from $196 billion in Fiscal Year (FY) 2022 (forecasted) to 193.5 billion in FY 2023. At the same time, agricultural imports are projected to expand by $5 billion from $192 billion in FY 2022 (forecasted) to $197 billion in FY 2023. The result is an agricultural trade deficit of $3.5 billion—the second largest deficit since 1990.

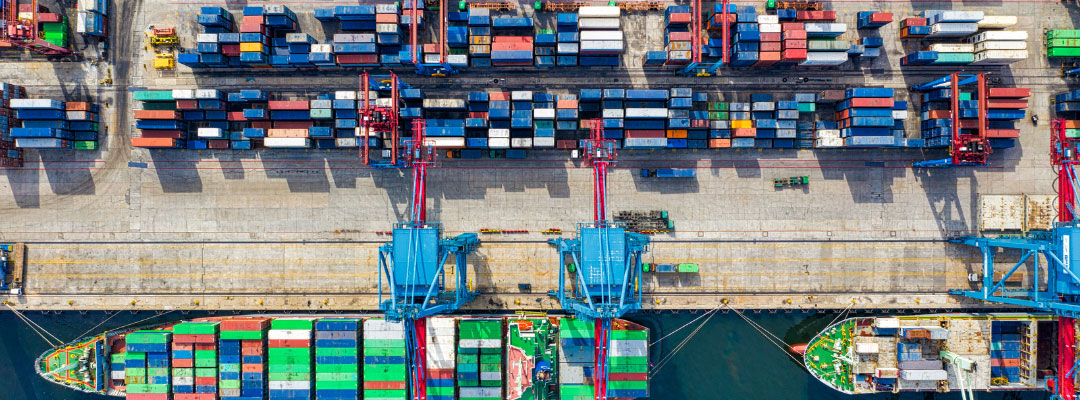

The primary macroeconomic factors driving these trade relationships are the persistent strength of the U.S. dollar relative to other major currencies, like the Euro and the Yen, and the sluggish economic performance in many parts of the world. In the short-term, poor economic growth will likely be exacerbated as central banks around the world tighten monetary policy to fight rising inflation rates. Moreover, while global supply chain crises have gradually faded this year, freight and shipping costs remain heightened as a result of hefty energy prices driven by the ongoing Russian invasion of Ukraine.

Alongside these macroeconomic factors, the drop in U.S. agricultural exports is also the result of tight domestic supplies of cotton, beef, and sorghum. The largest trade losses are expected to be with major trading partners, including the European Union (EU), South Korea, and Egypt, each of whom is expected to lose approximately $300 million in trade. The projected increase in agricultural imports is primarily driven by grain and feed imports (up by $0.9 billion), as well as increased imports of horticultural products (up by $2.9 billion) and sugar and tropical products (up by $1.8 billion).

Schaefer, K. Aleks, and Luis Ribera. “U.S. Agricultural Trade Deficit Projected for 2023.” Southern Ag Today 2(53.4). December 29, 2022. Permalink