Whole Farm Revenue Protection (WFRP) is a crop insurance product administered by the USDA Risk Management Agency (RMA). WFRP provides protection against the risk of farm revenue generated by all crops falling below a level of guaranteed revenue. Expected revenue is found by taking the most recently available five-year average of whole farm revenue reported on the Schedule F farm income tax form. For example, the expected revenue for 2024 is found by taking the average of revenue reported in 2018-2022. Subsequently, the expected revenue is multiplied by the producer-elected coverage level to determine the guaranteed revenue or WFRP liability. The WFRP revenue guarantee is capped at $17 million.

Like other multi-peril crop insurance (MPCI) products, the WFRP premium is subsidized by rates determined through federal legislation. The subsidy, or portion of the actuarially fair premium rate paid by the government, decreases as the elected coverage level increases. The WFRP producer premium may be further reduced through the Diversity Factor, which is a percentage multiplied by the actuarially fair rate. As the number of qualifying commodities insured increases, the greater the discount in the actuarially fair premium rate. Lastly, the WFRP producer premium may be reduced for those producers who have Beginning Farmer or Rancher or Veteran Farmer Status. Combining all three of these producer premium reductions can result in up to a 90% reduction in the actuarially fair premium.

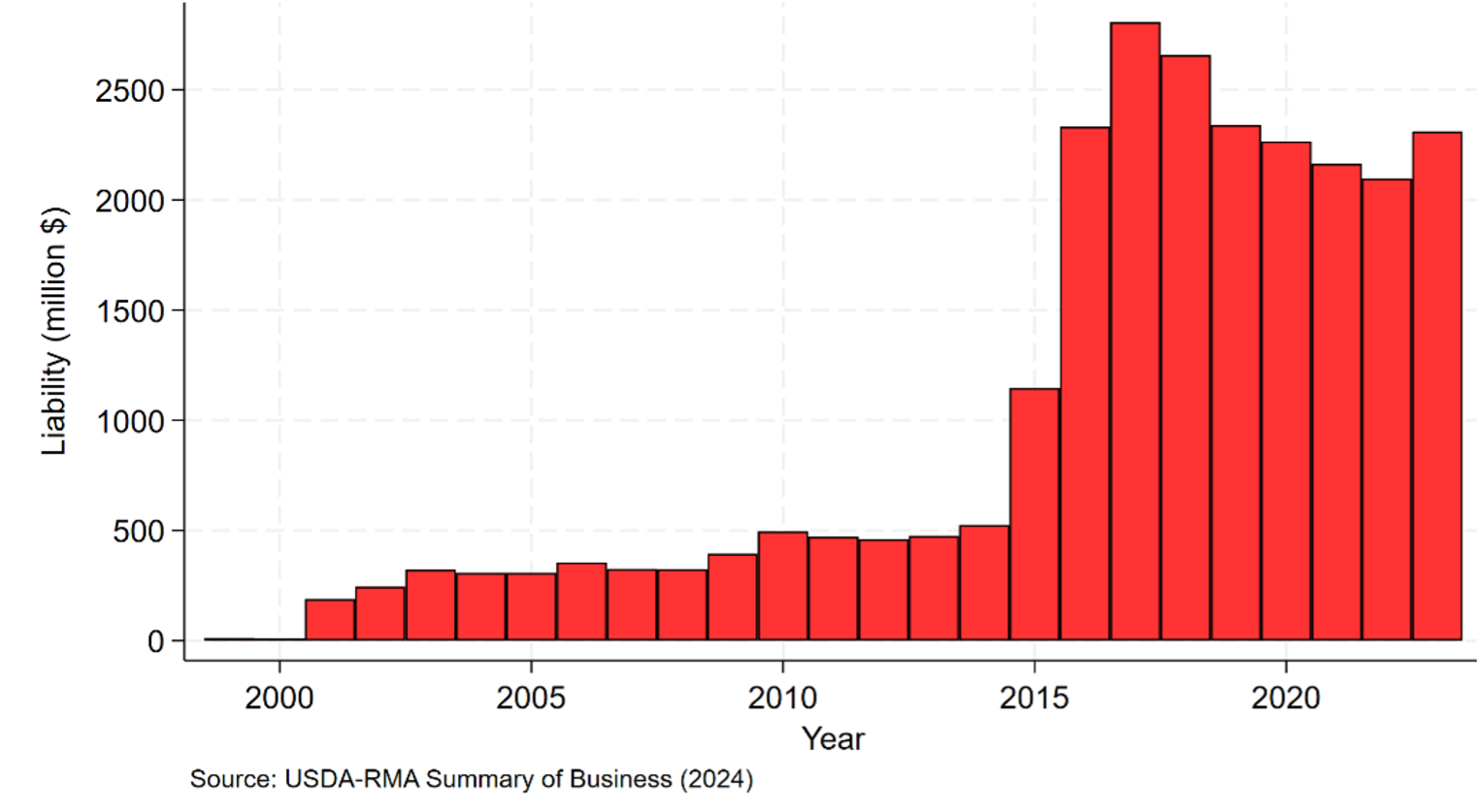

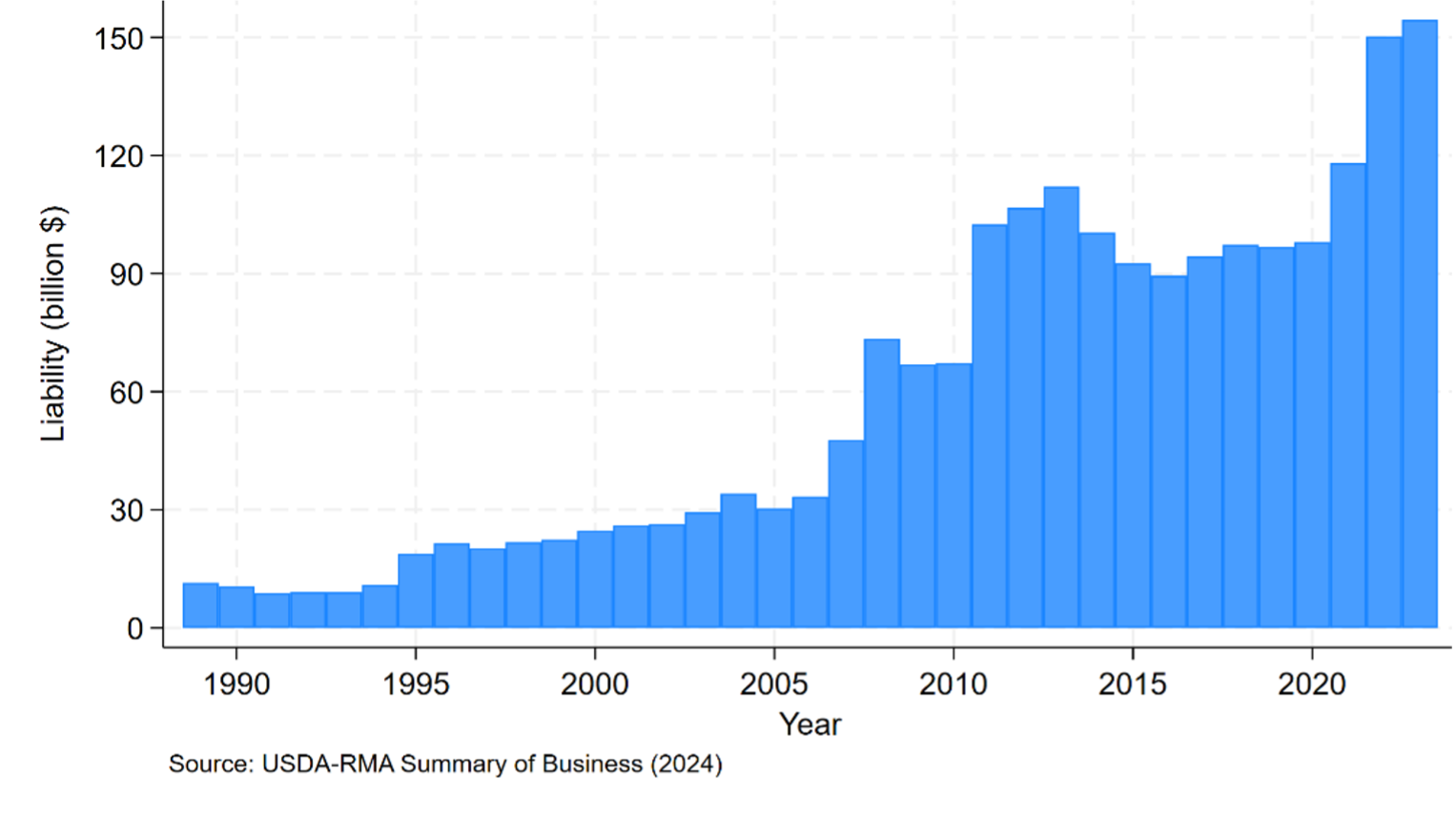

While the increasing trend in federal crop insurance participation since its inception can be largely attributed to increases in the premium subsidy rate, not all programs have experienced the same utilization (Yehouenou et al., 2018). Yehouenou et al. (2018) cite the reluctance of crop insurance agents to encourage purchasing STAX as one reason for the lack of participation despite the 80% premium subsidy rate attached to all coverage levels. Whole Farm Revenue Protection also faces a lag in participation and has experienced a decline in purchased liability since its inception in 2015. Average purchased liability of about $2 billion per year (Figure 1), which is far less than yield protection (YP) and revenue protection (RP) purchased liability which averaged over $100 billion over the same period (Figure 2).

One issue driving the lack of federal crop insurance participation is a lack of understanding of crop insurance programs. In response to this knowledge gap, RMA set up a number of cooperative agreements to build relationships, enhance understanding, and strengthen the public-private partnership of federal crop insurance across the agriculture community. In 2022, the University of Arkansas partnered on a two-year pilot program with RMA, the Crop Insurance Navigator program. The Navigator project seeks to address “knowledge gaps” of RMA products with a focus on historically underserved producer communities. The partnership is funded by the USDA Risk Management Agency. This southern region focused pilot is primarily designed to address the knowledge gaps present in WFRP and Micro-Farm products on both the part of producers and crop insurance agents. The program uses a cohort of project specialists to engage farmers, ranchers, educators, community-based organizations, and agricultural stakeholders to enhance understanding of federal crop insurance products serving small and historically underserved producer groups. To learn more about the Crop Insurance Navigator program visit https://srmec.uada.edu/navigator.html.

In an aligned effort to enhance understanding of crop insurance, UA faculty led the development of a workbook covering the fundamentals of federal crop insurance to educate producers, crop insurance agents, and policymakers with chapters on products and opportunities for socially disadvantaged farmers and ranchers. To access the workbook follow this link:https://www.uaex.uada.edu/publications/pdf/MP576.pdf

Figure 1. Whole Farm Revenue Purchased Liability (1999-2023)

Figure 2. Multi-Peril Crop Insurance Purchased Liability (1989-2023)

References

USDA-RMA. (2024). USDA-RMA Summary of Business. Retrieved February 20, 2024, from https://www.rma.usda.gov/SummaryOfBusiness

Yehouenou, L., Barnett, B. J., Harri, A., & Coble, K. H. (2018). STAX appeal?. Applied economic perspectives and policy, 40(4), 563-584.

Biram, Hunter, and Ron Rainey. “Addressing the Gap in Participation Between Whole Farm Revenue Protection and Other MPCI Products.” Southern Ag Today 4(45.1). November 4, 2024. Permalink