Commodity programs in Title I of the Farm Bill and the Federal Crop Insurance Program (FCIP) are the primary risk management tools available to agricultural producers. In a previous SAT article, Fischer and Biram (2025) discussed the suite of risk management tools available to cotton producers, the intention of Title I programs to supplement tools in the FCIP, and the different combinations allowed for producers to use in a risk management strategy. Notably, they discuss how base acres enrolled in either Price Loss Coverage (PLC) or Agriculture Risk Coverage (ARC) cannot be enrolled in the Stacked Income Protection (STAX) program. Since 87% of historical seed cotton base acres have been enrolled in PLC (USDA-FSA, 2025), with nearly all base acres enrolled in 2019 and 2020, this discussion focuses on the complementary nature of STAX and PLC.

On the surface, STAX and PLC may appear to be similar programs authorized under different pieces of legislation. However, a closer look reveals stark differences. STAX is a tool in the FCIP which provides protection against revenue losses based on a chosen coverage level, a cotton lint futures price, and a county cotton lint yield. PLC is a counter-cyclical target price program under Title I in the Farm Bill which provides only price downside protection determined by the effective reference price (ERP) and a Marketing Year Average Price (MYAP) for seed cotton. The ERP is a function of the statutory reference price determined by federal law and historical market conditions. More specifically, the seed cotton price is a production-weighted average of upland cotton lint and cotton seed prices (see Shurley and Rabinowitz, 2018and Liu, Rabinowitz, and Lai, 2019a). STAX requires a premium to be paid by the producer while PLC requires no out-of-pocket cost for enrollment. STAX pays indemnities based on planted acres and county cotton lint yield and price, while PLC payments are based on base acres and MYAP for seed cotton.

While STAX and PLC both provide price risk protection, it is in different markets and under different conditions. STAX provides price risk protection against declines in the futures market between planting and harvest with different regions of the country facing different price determination periods – and only to the extent that those declines are not offset by yield gains (see Liu, Chong, and Biram, 2024). PLC provides price risk protection against declines in the cash market within a crop marketing year which is August 1st through July 31st of the following calendar year (USDA-FSA, 2023). PLC protection is triggered when the MYAP falls below the ERP with the PLC payment rate being the difference between the ERP and MYAP.

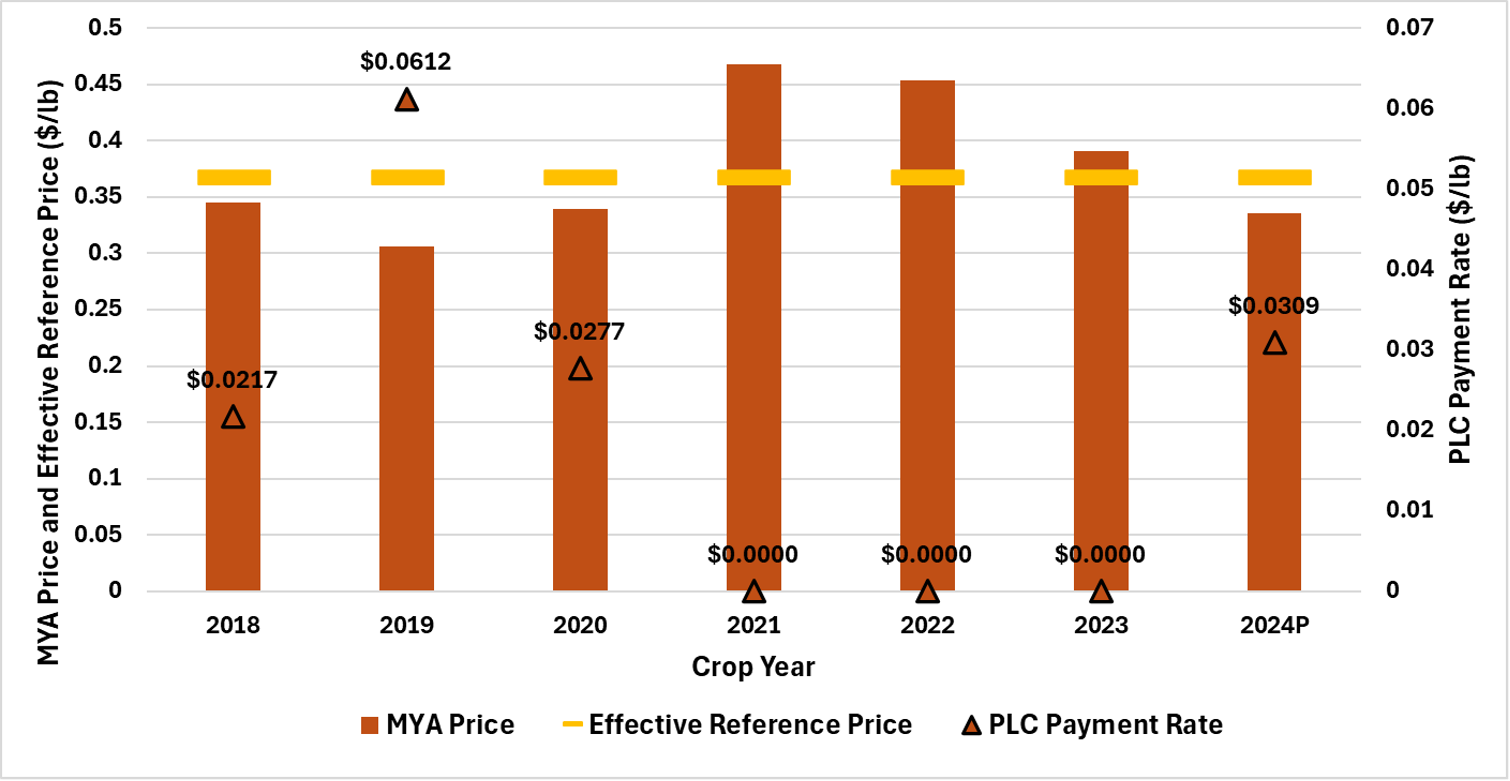

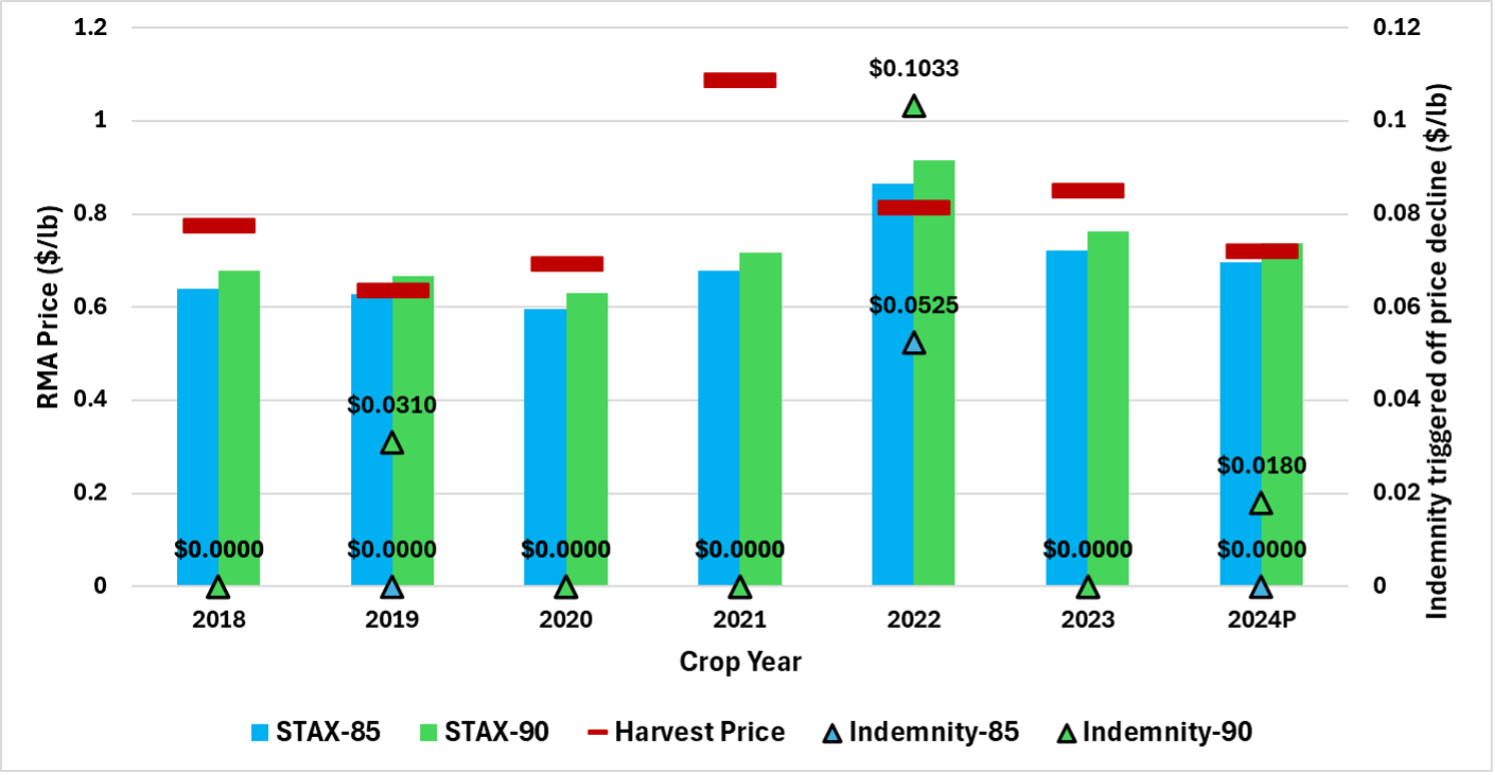

Since these two risk management tools provide different forms of price protection, it is no surprise that STAX indemnities based on price losses (i.e., in excess of any offsetting yield gains) differ from PLC payment rates. In the period authorized for risk protection in the 2018 Farm Bill (i.e., 2018-2024P), there was only one year in which both programs triggered, with 2024 projected to trigger at current prices. In 2019, the PLC payment rate for seed cotton was $0.0612/lb (see Figure 1) while the cotton lint STAX indemnity for price loss would have been $0.0310/lb (see Figure 2) which only would be for the 90% coverage level. There were three years when one program would have triggered when the other did not (2018, 2020, and 2022). The remaining two years saw no payments triggered by either program.

We acknowledge that these payment rates are based on different triggers (i.e., weighted average seed cotton price versus cotton lint price) and refrain from discussing the magnitude of the differences. Instead, we emphasize the fact that these programs often do not trigger in the same year, reinforcing the idea that these differences imply the need for risk protection in both the cash and futures markets, mitigating basis risk (see University of Arkansas fact sheet). As a result, Congress may wish to consider making both PLC and STAX available for a producer to use in the same crop year since they meet different risk management needs.

Figure 1. Historical Performance of Price Loss Coverage (PLC) for Seed Cotton (2018-2024P) This figure shows the years in which a seed cotton PLC payment triggered. The orange bars show the MYAP, while the yellow dashes show the ERP. The triangles denote the PLC payment rate recorded that year. When the orange bar is the below the yellow dash, a PLC payment triggers, and the triangle depicts the payment rate.

Figure 2. Historical Performance of Stacked Income Protection (2018-2024P) This figure shows the years in which a STAX payment would have triggered in a county with constant yields. That is, if the county yield did not fall, it depicts what the Harvest Price would have to fall to in order for an indemnity (i.e., insurance payment) to trigger. The blue and green bars show the price guarantee based on 85% and 90% coverage levels of STAX, respectively, while the red dashes show the RMA Harvest Price. The blue and green triangles denote the STAX indemnity recorded for the 85% and 90% coverage levels, respectively, in a given year. When the blue or green bar is below the red dash, a STAX indemnity triggers, and the triangles depict the payment rate.

References

Biram, H.D. and Connor, L. (2023). Types of Federal Crop Insurance Products: Individual and Area Plans. University of Arkansas System Division of Agriculture, Cooperative Extension Service Fact Sheet No. FSA75. https://www.uaex.uada.edu/publications/pdf/FSA75.pdf

Fischer, Bart L., and Biram, H.D. “STAX and PLC: Should Cotton Producers Have to Choose?” Southern Ag Today 5(15.4). April 10, 2025. Permalink

Liu, Y., F. Chong, and Biram, H.D. “Cotton Crop Insurance: Unveiling Regional Differences in Projected and Harvest Prices.” Southern Ag Today 4(4.3). January 24, 2024. Permalink

Liu, Y., Rabinowitz, A. N. & Lai, J. H. (2019). Understanding the 2018 Farm Bill Effective Reference Price. Department of Agricultural and Applied Economics, University of Georgia. Report No. AGECON-19-02PR. July 2019.

Liu, Y., Rabinowitz, A. N. & Lai, J. H. (2019). Computing the PLC and ARC Safety Net Payments in the 2018 Farm Bill. Department of Agricultural and Applied Economics, University of Georgia. Report No. AGECON-19-13PR. November 2019.

Shurley, D. & Rabinowitz, A. N. (2018). MYA Prices and Calculating Payments with the Seed Cotton PLC. Department of Agricultural and Applied Economics, University of Georgia. Report No. AGECON-18-03. February 2018.

U.S. Department of Agriculture, Farm Service Agency. (2023). Agriculture Risk Coverage (ARC) & Price Loss Coverage (PLC). December 2023. https://www.fsa.usda.gov/sites/default/files/2024-12/fsa_arc_plc_factsheet_1223.pdf

U.S. Department of Agriculture, Farm Service Agency. (2025). ARC and PLC Data. Date accessed: May 5, 2025. https://www.fsa.usda.gov/resources/programs/arc-plc/program-data

U.S. Department of Agriculture, Risk Management Agency. (2023). Stacked Income Protection Plan (STAX) for Upland Cotton. January 2024. https://www.rma.usda.gov/sites/default/files/2024-02/STAX-Upland-Cotton-Fact-Sheet.pdf

Biram, Hunter, Bart L. Fischer, Yangxuan Liu, Will Maples, and Amy Hagerman. “STAX and PLC: A Tale of Price Risk Protection in Two Markets.” Southern Ag Today 5(19.4). May 8, 2025. Permalink